- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

All Attention to Income Tax

New 2016 gave us quiet a lot of changes in the tax law and, unfortunately, mainly to the disfavor of taxpayers.

Thus, the Tax Code underwent serious alterations in the part of income tax. Introduction of a new quarterly statement form is one of such alterations.

So the most important document concerning most employers is Order of the FTS No. MMB-7-11/450@ dd. 14.10.2015. By this order the FTS approved the form for the calculation of the income tax estimated and paid by tax agents (form 6-NDFL), which since January 1, 2016 employers should quarterly submit to tax authorities.

Probably, the only positive aspect is that the Calculation represents summarized data on all individuals (amounts of accrued income and withheld tax on a cumulative total from the beginning of the tax period) instead of “personalized” account on each employee.

Calculation of income tax should be submitted to tax authorities electronically by telecommunication network. Except for employers, which have no more than 25 people employed and which can still submit statements in hard copy. Violation of statement form will result in penalty in the amount of 200 Rubles.

The deadline for the submission of quarterly Calculation of income tax to tax authorities is the last day of the month following the report period, it means April 30, July 31 and October 31.

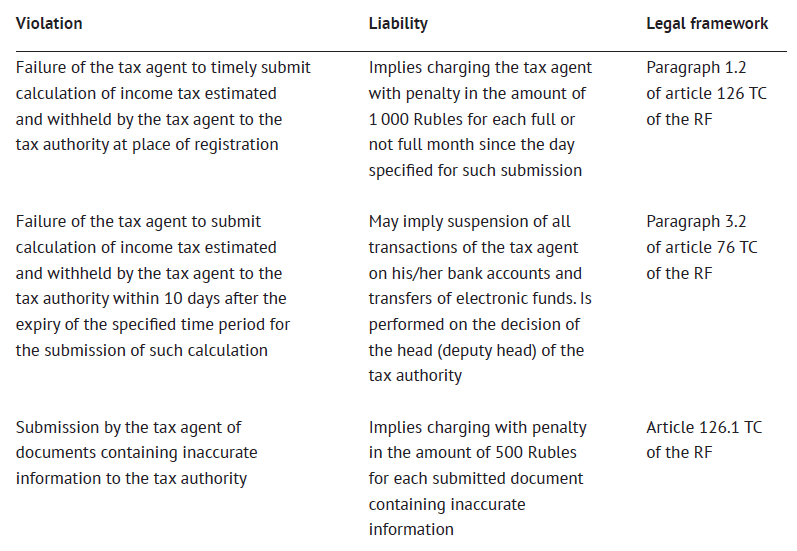

The legislator in particular worked hard in respect of liability of taxpayers (tax agents) for non-performance of their obligations regarding submission of Calculation of income tax to tax authorities. The illustrative table is provided below.

However, the tax agent submitting inaccurate information to tax authorities is released of liability, if he/she independently reveals errors and submits to the tax authority revised documents prior the moment the tax agent learns on the detection by the tax authority of inaccuracy of information contained in submitted documents. It means no penalty will be imposed for the submission of altered calculation.

Russian organizations having separated subdivisions and making payments to individuals in their separated subdivisions should submit quarterly Calculations of income tax both at place of business and at place of business of such separated subdivisions.

Thus, in 2016 additional burden falls on employers – tax agents on income tax. Surely, this fact does not induce joy, however, generation of Calculation should not cause any particular difficulties.

Sticking to the topic of income tax, it’s worth mentioning the important change concerning individuals, who own real estate. Amendments were introduced to the Tax Code at the end of 2014, but were enacted only since 01.01.2016.

Upon enactment of article 217.1 of the Tax Code of the Russian Federation the procedures for tax exemption at sale of real estate by individuals have changed, namely the minimum absolute time period for ownership of real estate object has changed.

As it was previously, income gained by an individual from the sale of real estate object is exempted of taxation provided such object was owned by the taxpayer within minimum absolute time period for ownership of real estate object and beyond. Until 2016, this period equaled 3 years without any additional terms.

Now minimum absolute time period for ownership of real estate object equals 3 years only for real estate objects satisfying at least one the following terms:

- The taxpayer obtained title to real estate object by way of inheritance or under the deed of gift from individual acknowledged as the family member and (or) close relative of such taxpayer in accordance with the Family Code of the Russian Federation;

- The taxpayer obtained title to real estate object by way of privatization;

- The taxpayer, annuity payer, obtained title to real estate object following the assignment of property under the life annuity agreement.

In all other cases the minimum absolute time period for ownership of real estate object equals five years.

Alterations introduced in respect of minimum absolute time period for ownership of real estate object curtail free disposal of real estate, which adversely affects taxpayers. However, it should be noted that legislators reserved the right of individuals to dispose of real estate obtained by way of inheritance, privatization or under the annuity agreement without any additional tax load.

In conclusion it should be mentioned that introduced amendments were quiet anticipated because actions on tightening of control for the payment of taxes are carried out for a long time already. Also, limitation of speculation with real estate by revision of requirements for tax exemption is quiet reasonable.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download