- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

FATCA: The US Tax Octopus and Its Worldwide Tentacles

What is FATCA?

The US Foreign Account Tax Compliance Act (FATCA) is no longer news. The Act was issued in 2010, and after that it survived several revisions and came into legal force on July 01, 2014. The Act was amended even after it had become legally effective, and foreign states one by one began signing tax information exchange agreements.

According to FATCA, all Foreign Financial Institutions (FFI), irrespective of the country of their registration and activities, are charged with the obligation to identify the US taxpayers among their clients and inform the US Internal Revenue Service (IRS) about them. If a client of a financial institution is a person counteracting performance of FATCA requirements (for example, does not provide full information required by FATCA and necessary for determining, whether such client is the US taxpayer), FATCA requires to withhold 30% of income from the American source (interest, dividends, royalties and etc.), transferred to such person, and to transfer the withheld funds to the US Internal Revenue Service (IRS).

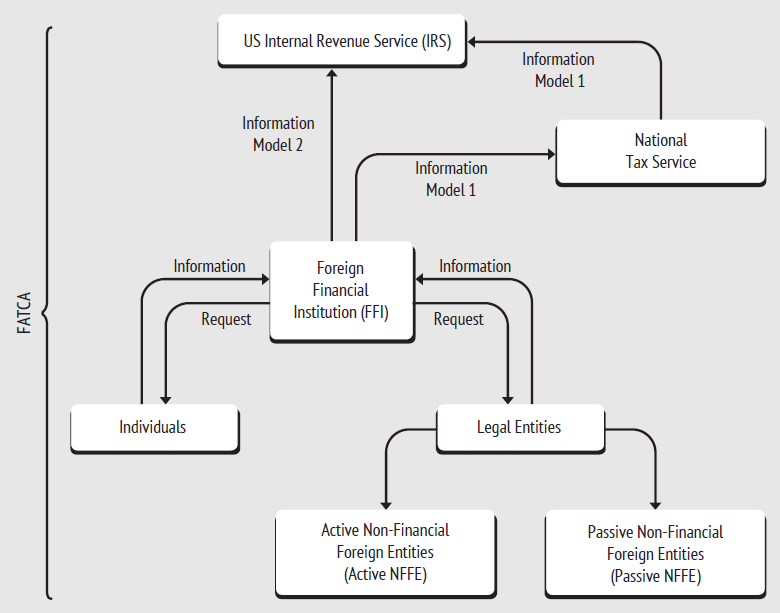

For the purpose of acquiring information on taxpayers, the US government has signed the International Governmental Agreements (IGA) with many countries. Two models of international governmental agreements have been developed – Model 1 and Model 2. Model 1 is more commonly used and stipulates exchange of information between tax authorities of the states that have signed the agreement and the US Internal Revenue Service (IRS). That is, Foreign Financial Institutions (FFI) must collect information about the clients being the US taxpayers and transfer it to the tax authority of their state. Model 2 stipulates transfer of information about the US taxpayers directly to the US Internal Revenue Service (IRS). There is also the third tax information transfer mode that obliges Foreign Financial Institutions (FFI) to adhere to FATCA requirements even in those states, which have not signed the agreement. Such regulation affected, for instance, the Russian Federation, where for the purposes of adherence to FATCA requirements Federal Law No. 173-FZ “On Peculiarities of Performance of Financial Transactions with Foreign Citizens and Legal Entities, on the Introduction of Amendments to the Code of the Russian Federation on Administrative Offences, and on the Annulment of Certain Acts of Legislation of the Russian Federation” dated June 28, 2014 has been issued. At present, the agreements within the framework of FATCA have been signed by more than 60 states.

The Main Point of Regulation

While elaborating FATCA, the American lawmakers tried to leave no chance to their taxpayers to hide information about them by defining so-called US Persons. Information about the US Persons, their accounts, as well as any other obtained financial information should be transferred to the US Internal Revenue Service (IRS). For the purposes of FATCA, the following persons shall be recognized as the US Persons:

- US citizens;

- US residents;

- Any legal entities (or any other entities),which are established / registered in the USA, in any US state or in the District of Columbia, or which are established / registered / acting according to the legal acts of the USA, any US state or the District of Columbia;

- Trusts, if according to applicable legal acts or statutory documents the US court is authorized to issue decrees or make judgments concerning virtually all issues related to trust administration, and one or more US persons are authorized to hold control over all significant decisions of the trust;

- The property of a deceased person, who was the US citizen or resident.

It should be noted that this list is not complete. Foreign Financial Institutions (FFI) must collect a variety of information to determine, whether the client has the status of the US Person. Even if the client has the US telephone number, he/she must inform the financial institution thereof.

The definition of a Foreign Financial Institution (FFI) is the next key moment of the FATCA law.

The following organizations shall be recognized as Foreign Financial Institutions (FFI) for the purposes of FATCA:

- Organizations that carry out banking activities or any other similar activities (Depository Institutions);

- Organizations that carry out custody activities (activities concerning accounting and storage of financial assets – Custodial Institutions);

- Investment Organizations (Investment Entities);

- Specialized Insurance Organizations (Specified Insurance Company);

- Companies being the members of a holding structure of financial institutions.

The abovementioned Foreign Financial Institutions (FFI) must be registered with the US Internal Revenue Service (IRS), where they are assigned a registration number for FATCA purposes (GIN). The report on the US taxpayers should be submitted once a year to the national tax service or to the US Internal Revenue Service (IRS), depending on the mode of submission of tax information.

Notwithstanding the fact that the report is to be submitted only with respect to the US taxpayers, Foreign Financial Institutions (FFI) must collect information on all their clients, including individuals and legal entities that are not the US Persons.

If the Companies are not Foreign Financial Institutions (FFI) or US Persons, for the purposes of FATCA they will be classified as Non-Financial Foreign Entities (NFFE). Non-Financial Foreign Entities (NFFE) are divided into passive (Passive NFFE) and active (Active NFFE). The main criterion for determining a non-financial entity as the active one, for the purposes of FATCA, is determining the type of income received by it. A company will be classified as Active Non-Financial Foreign Entity (NFFE), if less than 50% of income of the non-financial entity for the preceding calendar year or any other reporting period constitutes passive income and less than 50% of assets of the non-financial entity for the preceding calendar year or any other reporting period are the assets held for the purposes of acquiring passive income.

The US tax legislation contains the following definitions of passive income:

- Dividends;

- Interest;

- Income equivalent to interest, and income acquired from the pool of insurance agreements, if the amounts acquired completely or partially depend on pool profitability;

- Rent and royalty (except for the rent and royalty received in the course of active operating activities carried out, at least partially, by the entity’s employees);

- Annuities;

- Excess of proceeds over expenses related to the sale or exchange of property generating income described in paragraphs above;

- Excess of proceeds over expenses from transactions with exchange commodities (including futures, forwards and similar transactions), except for the following transactions: i) if such transactions are hedging transactions, and ii) transactions with such commodities are the principal activities of the company;

- Excess of income from foreign currency transactions (foreign exchange gains) over expenses related to foreign currency transactions (foreign exchange loss);

- Contracts, the value of which is pegged to the basic asset (nominal), for example, derivatives (e.g., currency SWAP, interest SWAP, options);

- Redemption amount under an insurance agreement (or loan amount secured by an insurance agreement);

- Amounts received by an insurance company for the account of reserves for carrying out the insurance activities and annuities.

In order to determine the type of income of a Non-Financial Foreign Entity (NFFE), it is necessary to refer to national legislation.

Foreign Financial Institutions (FFI) must also collect information on controlling persons of non-financial foreign entities. For the purposes of FATCA controlling persons shall mean individuals that exercise control over an organization. Such persons shall include beneficiaries, including cases when trust agreements are available. When controlling persons are legal entities (e.g., by funds), information about individuals exercising control over such legal entities (for instance, about directors) is requested.

Foreign Financial Institutions (FFI) collect information by sending request for the completion of special forms (Self-Certification Form), as well as special forms of the US Internal Revenue Service (IRS). It should be noted that the volume of the information provided depends to a great extent on the fact, which exactly Self-Certification Form a financial institution sends. The purpose of a financial institution is to collect the complete volume of information for submission of reports in conformity with FATCA; this however, the Self-Certification Form is elaborated by a financial institution independently. For example, some banks send a detailed form containing the glossary with necessary definitions for the purposes of classification under FATCA, allowing a client to make classification personally. In a number of cases, upon classifying a client as an Active non-financial foreign entity according to FATCA, information on controlling persons is not requested. There is a great number of opposite examples, when banks request information on beneficiaries and the type of income received by a company and after that perform classification by themselves.

The FATCA mechanism is more clearly shown in the following diagram:

The FATCA legislation has been already distributed worldwide. Its effect extends even to those countries that did not sign the International Agreement (IGA). Surely, first of all it affects the US Persons, but all other persons also have to provide information about them, thus, proving their noninvolvement with the USA. In this article we tried to give the reader the basic understanding of principles of the tax information exchange under FATCA; however, the law itself contains more detailed description of financial institutions, taxpayers’ accounts, information on which is subject to submission, as well as description of principles of classifying non-financial entities. By becoming a client of a financial institution, in the most common case – a bank client, either in Russia or abroad, the reader may encounter the requirements of FATCA law face to face. Even not being the US Person, it is necessary to provide exact and authentic information when completing the forms. In practice, the forms for providing the information may contain too much or, which is more often, too little information for understanding one’s exact status within the framework of FATCA. In such cases the best option is to refer to specialists.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download