- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

Trends in the Russian Judicial Practice on Tax Disputes following the results of 2015

For most taxpayers 2015 was quite eventful and crucial. This year, a lot of amendments were introduced to the tax law, which on one part aimed at crackdown in relations between the state and the taxpayer (adoption of law on deoffshorization, on actual income recipient, on control over accounts of taxpayers, on the introduction of liability for individuals to submit statements on movements on foreign accounts), and on the other part, during the transition period Russian taxpayers have been granted opportunity to voluntarily notify on their foreign property in exchange for guarantee of relief on liability for tax violations (related to formation of sources of acquisition of foreign property), and also of collection of tax arrears (“Capital Amnesty”).

But despite that, recent amendments in the tax law, none the less, are not intended to ease the situation of taxpayers and relax control of the state.

Unfortunately, as the analysis of judicial practice on tax disputes in 2015 reveals, most key judgments were also made against taxpayers. Thus, this year judicial authorities did not add honey to the barrel of turmoil and stress of Russian taxpayers.

This article invites you to have a look at key judgments and main trends in the development of Russian judicial practice in 2015.

Trend No. 1: Russian courts begin to apply concept of actual income recipient introduced in the Tax Code of the Russian Federation since 01.01.2015 to the full extent

Concept of actual income recipient lies in the following: if international treaty of the Russian Federation on taxation stipulates application of reduced tax rate or release of taxation in respect of income sourced in the Russian Federation for foreign parties de facto entitled to such income, for the purpose of enforcement of such international treaty a foreign party shall not be deemed de facto entitled to such income, if it has limited authority in respect of disposal of such income, carries out mediation functions in respect of such income for the benefit of other party without performing any other functions and without accepting any risks, directly or indirectly paying such income (fully or partially) to such other party, which in case of direct receipt of such income sourced in the Russian Federation would not have been entitled to apply the said provisions of the international treaty of the Russian Federation on taxation1.

Tax authorities (and also courts) most actively apply this concept to transactions on payment to the Russian organization of indirect income (dividends, interest, royalties) to the benefit of a foreign company registered in the state having tax treaty with the Russian Federation. In such case inspection authorities and courts recognize a foreign company as conduit and de facto not entitled to gained income, at the same time denying Russian organization to apply reduced rates of withholding tax, and also to recognize the said payments in expenditures at income tax base formation by the Russian company.

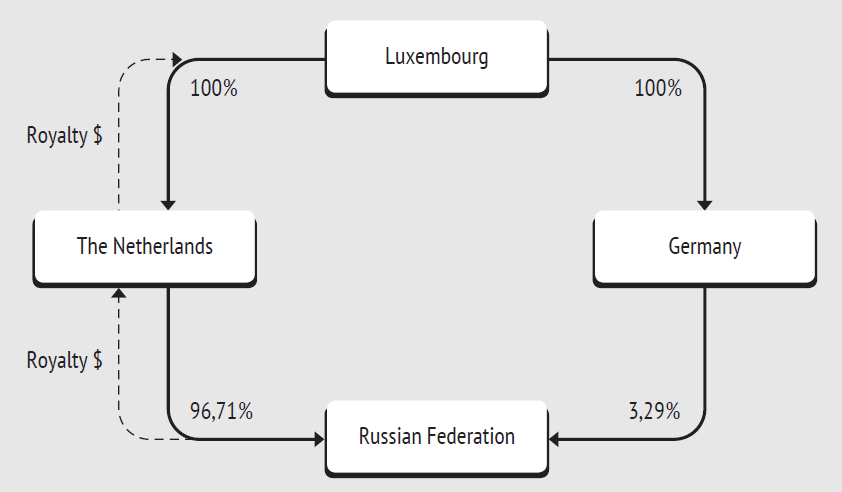

In this situation, Oriflame Cosmetics case became the most illustrative example. In this case the Russian company entered with its parent company in a number of contracts for the transfer of exclusive rights, which in its turn executed similar contract with its parent company.

By paying to the foreign company license fee (royalty), the Russian company:

- As tax agent withheld VAT on the said amounts and subsequently declared for deduction paid VAT amounts;

- Recognized royalty amounts in expenditures at income tax base formation.

The scheme outlines it as follows:

Tax authority additionally charged from the company the value added tax (withheld by it as a tax agent at payment of royalty and declared for deduction), and also income tax (due to the refusal to accept as expenditures amounts of paid royalties).

Courts dismissed the Company’s claims in full2. On the basis of analysis of this case (more detailed analysis of this case was published in the previous edition) it appears that the said case was more like a show trial revealing general feeling and position of the state (including the legislator, law enforcer and controlling authorities) in respect of schemes of tax optimization aimed at the use of legal business structures with the goal of applying exemptions and concessions of international tax planning and of taking capital abroad. More likely, such position of the state in modern political and economic conditions is natural rather than unexpected.

Subsequent judgments made by courts on similar cases also indicate the intention of courts to follow the chosen path3. For example, in the case of Petelino Trading House the similar situation was considered.

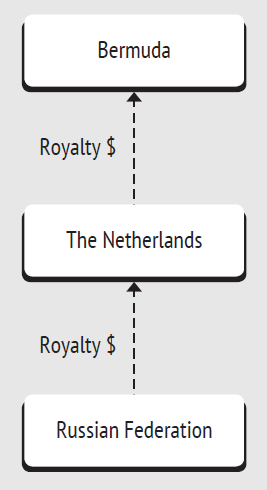

In this case the Russian company entered into the sublicense contract with the Cyprian company, which in its turn acquired license from the rights holder registered in the Bermuda.

However, the following circumstances provided the basis for the judgment of tax authority and the court:

- The rights holder (the Bermuda company), the licensee (the Cyprian company) and the sublicensee (the Russian company) are affiliates and comprise one group of companies according to the publicly available lists of affiliates;

- License and sublicense contracts were entered with minimum time interval;

- The cost of the sublicense contract exceeds the cost of the license contract by many times;

- Existence of tax treaty between the Russian Federation and Cyprus and absence of such treaty between the Russian Federation and the Bermuda;

- The company had objective opportunity to enter into the license contract directly with the rights holder.

The said circumstances allowed the tax authority to arrive at the conclusion that the only goal of this scenario was gaining by the company of tax benefit by means of non-payment of tax on income received by foreign organization from resources in the Russian Federation withheld by the tax agent.

Trend No. 2: Practice at consideration of disputes related to “thin capitalization” is tightened

Experience has proven that debt financing holds key positions among other financing methods within holdings. When a foreign company grants a loan to the Russian affiliate, as a rule, it pursues several goals. First of all, it is an opportunity of operational financing of the company’s activity when the company needs it. However, besides that, debt financing is also an effective tax tool, which allows regulating tax burden of the Russian borrowing company.

However, regarding application of the said tax tool the current tax law of the Russian Federation specifies certain limitations in part of accounting and taxation of interest profit on controlled indebtedness. Controlled Indebtedness (CI) is recognized as outstanding indebtedness of the Russian organization4:

- On debt obligations to the foreign company, directly or indirectly owning more than 20% of the authorized capital of this Russian organization;

- Or on debt obligation to the Russian organization recognized as an affiliate of the abovementioned foreign organization;

- Or on debt obligation, in respect of which such affiliate and/or directly this foreign organization acts as a surety, guarantor or otherwise is liable to secure fulfillment of debt obligation of the Russian organization.

Amount of which exceeds the borrower’s own capital by 3 times (the difference between the amount of assets and the size of obligations) as of the last day of the report (tax) period at determining the maximum amount of interest to be recognized as expenditures.

However, during the last year the position of controlling and judicial authorities on this matter has significantly tightened. Thus, for example, controlling authorities reckon among other things that rules on controlled indebtedness should apply only at direct, but also at indirect dependence between the Russian taxpayer and loan recipient and the foreign lending company. That is why outstanding indebtedness on debt obligation of the Russian organization to the foreign “sister” organization is also recognized as controlled indebtedness.

This conclusion has been made by the Ministry of Finance of the Russian Federation5 on the basis of Comments of the Organization for Economic Co-operation and Development (OECD) on the Model of Convention on Income and Capital Taxes, on the basis of which most states enter into treaties for the avoidance of double taxation. OECD Comments specify that for the application of “thin capitalization” rules it is not required for the borrower to be subsidiary of the creditor. For example, they both can be subsidiaries of the third party, together be part of one group of companies or holding controlled by such party and etc.

Approach set forth by the Ministry of Finance of the Russian Federation was also supported by arbitration courts at settlement of tax disputes in cases on controlled indebtedness. See, in particular: Order of the Arbitration Court of the North-Western District dd. 19.06.2015 on case No. A56-41307/2014; Order of the Arbitration Court of Moscow District dd. 13.04.2015 on case No. A40-41135/14; Order of the Arbitration Court of Moscow District dd. 27.02.2015 on case No. A40-30682/14.

Other important issue at consideration of cases of such category is the issue of controversy between provisions on controlled indebtedness (Article 269 of the Tax Code of the Russian Federation) and international tax treaties, which allow the taxpayer without any limit to take on account interest on loans granted by the foreign incorporator (non-discrimination principle). In recent years practice on this issue has also tightened significantly. If previously judicial practice was not the same and there were judgments made in favor of taxpayers (Order of the Federal Arbitration Court of the West Siberian District dd. 05.06.2008 on case No. A70-5054/2007, Order of the Federal Arbitration Court of Moscow District dd. 13.12.2010 on case No. AA40-138021/09), now courts come to the explicit conclusion that international tax treaties leave open possibility of stipulating special taxation rules under the national law as means of struggle against minimization of taxation (Order of the Federal Arbitration Court of the Far Eastern Federal District dd. 13.02.2014 on case No. A04-1595/2013, Order of the Arbitration Court of the North-Western District dd. 19.06.2015 on case No. A56-41307/2014).

In this case, the culmination of judgments was Definitions of the Constitutional Court of the Russian Federation No. 1578-O dd. 17.07.2014, No. 695-O dd. 24.03.2015, in which the court arrived at the conclusion that thin capitalization rules are aimed at prevention of abuse in tax legal relations and existence of such requirements in the Tax Code of the Russian Federation does not mean that they stipulate other rules than those specified in international tax treaties.

Trend No. 3: Courts cease admitting the taxpayer’s right to recognize royalties paid to the related company as expenditures

2014-2015 became crucial in practice of taxation of license fees (for the use of trademarks, patents, know-how and etc.).

If above we have discussed cases on taxation of royalty from the perspective of application of concept of de facto income recipient, in practice courts and tax authorities have also other issues arising, in particular, issue on economic feasibility of expenses in form of royalties.

For example, previously there was a quite popular scheme, following which foreign parent companies transferred to Russian subsidiaries under license contracts rights to use various corporate resources and methods applied within the holding (procedures for paperwork management, standards of work quality, by-laws, administrative information resources). The said rights were transferred as know-how or various technologies.

Initially the courts recognized the right of existence of such schemes, which is confirmed, for example, by case of Ekvant, LLC No. A40-36263/10, where a taxpayer managed to prove the actual value of acquired rights for technology (and thus economic feasibility of incurred expenses) and absence of interdependence between parties of the license contract. However, later the same taxpayer (Ekvant, LLC) did not manage to win in dispute with tax authorities at consideration of the same issue, but following the results of another time period (see Order of the 9th Arbitration Appeal Court of Moscow dd. 25.02.2015 on case No. A40-28065/13).

Tax authorities managed to win this time with the help of foreign colleagues, which submitted required information on the basis of numerous international requests, on the basis of which the tax authority and the court managed to arrive at the following conclusions:

- The rights holder did not acquire or create technology independently;

- The rights holder was a transitional element between the parent company and subsidiaries of the holding;

- The rights holder (as well as the licensee) did not pay income taxes due to losses carried over to future periods;

- Other subsidiaries comprising the holding did not pay similar license fees for the use of technology.

The said conclusions provide the basis of judgment, which left standing the judgment of tax authority on denying the taxpayer to protect its rights.

Besides reviewed cases, other illustrative cases on significant tax disputes in 2015 can be emphasized (case of the Russian representative office of Freshfields Bruckhaus Deringer on the possibility of recognizing expenses of the parent subdivision No. A40-3279/14, case of Sony Mobile Communications Rus, LLC on double taxation of insurance payments – Order of the Constitutional Court of the Russian Federation dd. 01.07.2015 No. 19-P), however within one article it is impossible to address and analyze all judgments.

As general analysis of recent judicial practice reveals, tax authorities securing the support of courts started to deal quite successfully with the most popular tools of tax planning used by Russian organizations recognizing them as “schemes”. Also, special attention should be paid to the trend of rising quality and increase of information sources, which tax authorities started to use for the purposes of collecting proofs, in particular, widespread development of practice of international information exchange.

Due to this, we recommend taxpayers to carry out deep analysis of their economic activity to detect transactions, which may be recognized as risk-related in light of changing judicial practice.

- Paragraph 3 Article 7 of the Tax Code of the Russian Federation.

- Order of the Federal Arbitration Court of Moscow District dd. 11.06.2015 on case No. A40-138879/14.

- See Judgment of Moscow Arbitration Court dd. 08.05.2015 on case No. A40-12815/15, left standing under Order of the 9th.Arbitration Appeal Court of Moscow dd. 04.08.2014 on case No. A40-12815/15.

- Paragraph 2 Article 269 of the Tax Code of the Russian Federation.

- Letter of the Ministry of Finance No. GD-4-3/10807@ dd. 22.06.2015.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download