- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

Same Old Story. Unified Social Tax

As we all know, from 2017 tax authorities have resumed the administration of insurance premiums, for which reason budget classification codes and the form of insurance premiums calculation have been changed.

In this regard, taxpayers have many questions:

- How to amend the reports for 2016 and earlier periods and where to submit them?

- Under which budget classification codes shall the taxes for 2016 and earlier periods be paid?

- Is it necessary to submit any reports to the Pension Fund and the Social Insurance Fund in 2017 or should the reports be submitted to tax authorities only?

- How to complete the new reporting form and within what timeframe?

There are many questions indeed, because any changes create a misunderstanding between the administrative authority and the payer. While everything is clear about the payment, the first reports are to be prepared and submitted to tax authorities only in early May.

The Federal Tax Service has issued Taxpayer’s Memo, which was sent by telecommunications channels, to help the taxpayers. The following issues are explained in this memo:

- From January 01, 2017 the payment of insurance premiums, including for accounting periods which have expired before January 01, 2017, shall be made under the new budget classification codes (effective from 01.01.2017);

- Calculations for accrued and paid insurance premiums for 2016 and updated calculations for the periods from 2010 to 2016 shall be submitted to territorial bodies of the Pension Fund and the Social Insurance Fund in the forms and formats effective during the respective calculation period;

- Calculations for insurance premiums for reporting (calculation) periods, starting with reports for the 1st quarter of 2017, shall be submitted to tax authorities at the place of registration;

- Calculations for accrued and paid insurance premiums for compulsory insurance against industrial accidents and occupational illnesses as well as for the expenses for the payment of insurance coverage in the 4-FSS form shall be submitted to territorial bodies of the Russian Social Insurance Fund starting with the reports for the 1st quarter of 2017.

However, the specified memo does not include information that the obligation to submit the reports in the SZV-M form, which was submitted monthly in 2016, has not been withdrawn from the payers of insurance premiums.

Despite the fact that only one regulatory authority will exercise control over the completeness of calculation and payment of insurance premiums instead of three non-budgetary funds, there will not be less reports in 2017.

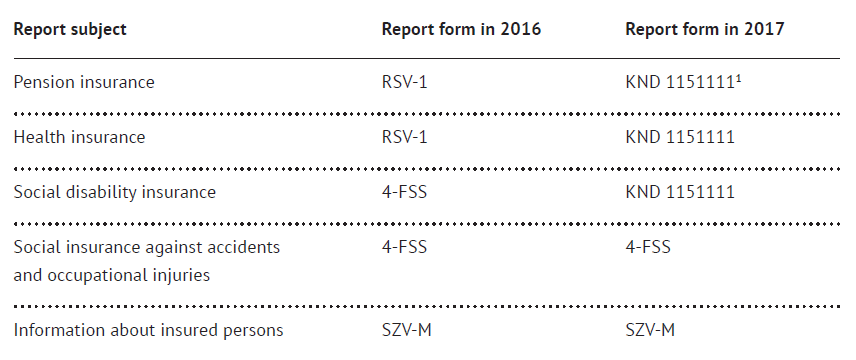

The new Calculation of Insurance Premiums combines the RSV-1 and 4-FSS forms, although the social insurance against accidents and occupational injuries remains in the competence of the Social Insurance Fund, and a separate 4-FSS calculation shall be submitted on these premiums.

Thus, the desire of legislators to get rid of excess bureaucracy has currently produced no results. However, this is just the first year of the new rules.

The reports for the periods preceding 2017 shall be submitted in the formats effective during the reporting period for which the reports are submitted, but the payment shall be made under the new budget classification codes.

The insurance premiums for the periods preceding 2017 shall be paid under the following budget classification codes:

- For pension insurance – 182 1 02 02010 06 1000 160;

- For health insurance – 182 1 02 02101 08 1011 160;

- For social disability insurance – 182 1 02 02090 07 1000 160.

The insurance premiums for the periods starting from January 01, 2017 shall be paid under the following budget classification codes:

- For pension insurance – 182 1 02 02010 06 1010 160;

- For health insurance – 182 1 02 02101 08 1013 160;

- For social disability insurance – 182 1 02 02090 07 1010 160.

Procedure of calculation and payment of insurance premiums as well as procedure of submission of reports on insurance premiums is now contained in Chapter 34 Insurance Premiums of the Tax Code of the Russian Federation.

Essentially, Chapter 34 of the Tax Code of the Russian Federation largely conforms to the law on insurance premiums2, which, albeit regular amendments, has been used by the payers of insurance premiums for six years.

A significant difference from the last year’s rules is the change in the procedure of levying daily allowances for business trips. If the amounts of the daily allowances were not subject to insurance premiums in the amount stipulated by local regulations earlier on, now the amount of the daily allowances within 700 RUB for business trips in the Russian Federation and within 2 500 RUB for foreign business trips is not subject to insurance premiums.

That is, from January 01, 2017 the unified limits of the amounts of daily allowances which are not subject to individual income tax and insurance premiums have been established.

From 2017, the new deadline for submitting the reports on insurance premiums to regulatory bodies has been established. Now, the submission deadline is not the 15th day of the second month after the end of the reporting period, but 30 days from the end of the reporting period (quarter).

Several amendments have been introduced into the Law On Individual (Personified) Accounting in Compulsory Pension Insurance System3 in terms of extending the deadline for the submission of the SZV-M report. From January 01, 2017 the said report shall be submitted to the Russian Pension Fund until the 15th day of the month following the reporting period. As before, the reporting period is a calendar month.

A distressing innovation of the new revision of the law on personified accounting is the fine for a hard copy of personified accounting data by organizations with staff of more than 25 people. The fine is 1 000 RUB.

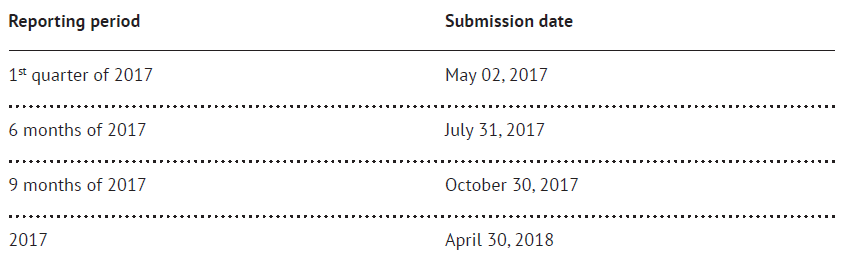

In 2017 quarterly Calculations of Insurance Premiums (under the KND 1151111 form) shall be prepared and submitted to tax authorities within the following periods:

Deadlines for payment of the insurance premiums remain the same – until the 15th day of the month following the month of income accrual.

The bodies of the Russian Pension Insurance Fund, the Social Insurance Fund and the Federal Tax Service have been actively publishing explanatory information on their official websites since July 2016.

The website of the Russian Pension Insurance Fund contains information that in 2017 the territorial bodies of the Russian Pension Insurance Fund and the Social Insurance Fund retain the functions of on-site (repeated on-site) audits for the periods before January 01, 2017. The on-site audits are performed in the manner effective before January 01 of the current year. The audit shall cover the period not exceeding three calendar years preceding the calendar year when it was resolved to conduct the on-site audit. Simply put, in 2017 the Russian Pension Insurance Fund and the Social Insurance Fund will conduct on-site audits for the period from 2014 till 2016.

The retention of the specified functions by the Russian Pension Insurance Fund and the Social Insurance Fund is well justified, since the reports for 2014 – 2016 were submitted to the funds and the Federal Tax Service will not be able to audit the periods ended before 2017.

The Russian Federal Tax Service has stated that if the information about the aggregate amount of insurance premiums for compulsory pension insurance does not conform to the information about the calculated premiums for each insured person in the submitted calculation of insurance premiums, and (or) tax authorities reveal unreliable personal data identifying the insured individuals, such calculation shall be deemed non-submitted, of which the payer will be sent the respective notice.

In this regard, the payers should carefully fill in the reports on insurance premiums and timely submit these reports so as to be able to make adjustments in the event of receipt of a negative protocol from the Federal Tax Service.

The Ministry of Finance in its turn has pointed to the fact that the explanations given by the Ministry of Labor and Social Protection, the Russian Pension Fund, the Social Insurance Fund and the Ministry of Health and Social Development may be applied to the extent that does not contradict the Tax Code of the Russian Federation.

Thus, summing up the changes in the laws on insurance premiums, we can single out one change in favor of the payers of the premiums:

- Postponement of the deadline for the submission of the SZV-M report from the 10th to the 15th day of each month.

The negative changes are as follows:

- Postponement of the deadline for the submission of the report on insurance premiums from the 15th day of the second month following the reporting month to the 30th day of the month following the reporting month;

- Introduction of limits for the exemption of the daily allowances from insurance premiums;

- Introduction of a fine for the violation of the procedure for the submission of the report on insurance premiums to tax authorities;

- The fact that the calculation shall be deemed non-submitted if the information about the aggregate amount of the premiums does not conform to personified data or if there are unreliable personal data of the insured persons in the calculation on insurance premiums.

Introduction of the new calculation form will not in any way affect the payers of insurance premiums, except the need to find time to study the instruction for the completion of the form.

Detailed instructions for filling in the new calculation of insurance premiums are contained in Decree of the Federal Tax Service No. ММВ-7-11/551@ On the Approval of the Form of Calculation of Insurance Premiums, the Procedure for Its Completion and the Format of Submission of Online Calculations of Insurance Premiums dated October 10, 2016.

- Approved by Decree of the Russian Federal Tax Service No. ММВ-7-11/551@ dated 10.10.2016 (Registered in the Russian Ministry of Justice under No. 44141on 26.10.2016).

- Federal Law on Insurance Premiums No.212-fz dated 24.07.2009 On Insurance Premiums to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation and the Federal Health Insurance Fund.

- Federal Law On Individual (Personified) Accounting in Compulsory Pension Insurance System No. 27-fz dated 01.04.1996.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download