- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

In accordance with the generally accepted definition, “crowdfunding” means collective cooperation of individuals who voluntarily pool their money and/or other resources together (usually via the Internet) to support initiatives, efforts and projects of other people or entities. However fundraising can be carried out for different purposes – support of political campaigns, fundraising for needy citizens (socially disadvantaged people, victims of natural disasters, sick, deprived people, etc.), making profit from joint investment, etc.

Currently, there are two basic models of crowdfunding: project funding, when the transferor of funds does not expect to make a profit, and when it expects to make profit from project.

The crowdfunding platform is generally used in order to attract and get interested as many potential investors as possible that, carrying out a number of non-trivial operations (registration on the platform, transfer of the required amount of funds), invest in the relevant project, receiving in return various gifts, presence in the list of authors, income from joint investments or simply moral satisfaction (in the case of a free donation) and thanks from author of project (recipient of funds).

It worth mentioning that the foreign law has a fairly well-developed legal framework governing mechanisms and interaction of parties of legal relations (investor – crowdfunding platform – recipient of funding), and allowing implementing most of the existing methods for raising funds of investors (see below).

The US experience may serve as an example of developed instrument of legal regulation. In particular, recently The Jumpstart Our Business Startups Act of 2012 (Jobs Act) was adopted. This regulatory act is aimed at providing support to subjects of entrepreneurship in fundraising on public capital markets by reducing regulatory requirements and state control of issuers of the relevant financial instruments.

What can not be said about the Russian legislation is that Russia has no clear legal regulation of such phenomena as crowdfunding, offences and the status of persons involved in such method of funding at the legislative level is not sufficiently specific. In this regard, the application in the Russian Federation of some methods of attracting investments becomes difficult, and in some cases is even impossible.

However, despite significant gaps in the legislative regulation of the Russian Federation, the practice of establishment and successful functioning of crowdfunding platforms in the legal field of the Russian Federation nevertheless exists.

This is explained by the fact that the instrument itself of attracting financial flows is quite popular and has successfully established itself in foreign countries, therefore organizers of crowdfunding platforms have to eliminate the gaps in the legal regulation of the crowdfunding institute by using legal instruments provided for by the current RF legislation, the most useful for the regulation of such institution, i.e. in this case we can talk about the use of analogy of law.

In cases where the civil and legal relations are not directly regulated by legislation or agreement of the parties and there is no custom applicable to them, the civil law regulating similar relations (analogy of law) applies to such relations provided this does not contradict their essence1. It if is impossible to use analogy of law the parties’ obligations are determined on the basis of general principles and sense of the civil legislation (analogy of law) and requirements of good faith, reasonableness and fairness2.

Based on the above, we suggest you to familiarize yourself with the example of legal shell, which can cover the relations of participants, founders and users of the crowdfunding platform.

Ways to raise funds

The company, which intends to use the crowdfunding mechanism (for example, to form a start-up capital), as a rule, takes advantage of the Internet networks to get financial support (investments, contributions, donations, etc.) from persons that, as a rule, are not professional financiers. Nevertheless, the ways to attract investment can be quite diverse, for example:

- Fundraising in the absence of any counter-material benefit proposed to investors or, for example, in exchange for gratitude or media coverage of names of the donor (gift, donation);

- Fundraising in exchange of future transfer to investors of any result of works, services (for example, transfer to investor of a gift copy of released audio CD, published book, etc.);

- Fundraising under the terms of loan (micro-funding);

- Raising funds from investors in exchange for participation of the same in the authorized capital of the start-up company (sale of shares/stocks in the company’s authorized capital), etc.

-

Gift

The deed of gift means an agreement under which a party (the donor) conveys free of charge or agrees to convey to another party (the donee) a thing with the right of ownership or property right (right to claim) to itself or to a third party or release or commit to release it from property liability to itself or to a third party3.

In accordance with the RF civil legislation, the concept of “thing” covered such subjects of civil rights, as cash and certificated securities, other assets, including non-cash financial resources, un-certificated securities, property rights4.

Thus, the law allows the participant of civil and legal relations making transactions aimed at gifting money.

However, there are certain requirements and restrictions to conclusion of the deed of gift.

The gift is conveyed by handing it, by symbolic transfer (handing over keys, etc.) or by handing documents of title.

Gifting, accompanied by transfer of gift to the donee, may be made verbally, except for the following cases5. Thus, the deed of gift of movable property shall be executed in writing when:

- The donor is a legal entity, and the cost of the gift exceeds three thousand rubles;

- The deed contains a promise of future gift.

Otherwise, the deed of gift made verbally is deemed void.

Besides, the law prohibits gift, except for usual gifts the value of which does not exceed three thousand rubles6:

- On behalf of minors and citizens declared legally incapable by their legal representatives;

- To employees of educational institutions, healthcare organizations, organizations providing social services and similar organizations, including organizations for orphans and children left without parental care, citizens who are there for treatment, dependence or education purposes, spouses and relatives of these citizens;

- To persons who hold public offices in the Russian Federation, government offices in subjects of the Russian Federation, municipal offices, government officers, municipal officers, officers of the Bank of Russia in connection with their official position or performance of their duties;

- In relations between commercial organizations.

In terms of the fiscal and legal burden of the parties to the gift transaction, the following shall be noted:

In the event that the project Initiator (recipient of funds) acts as individual, then the initiator shall not calculate and pay the individual income tax on the funds received under the deed of gift. This is due to the fact that in accordance with the current tax legislation, income in cash and in kind received from individuals by means of gift (except for cases of gift of real estate, vehicles, stocks, shares, units) is exempt from taxation7.

In case where the initiator is a legal entity, the recipient of funds, as a general rule, must recognize the non-operating income, as well as assess and pay the profits tax8.

If the entity is registered in the general taxation system, the rate of the profits tax makes up 20%9.

If the entity applies the simplified taxation system, the rate of the profits tax can make up 6% (if the subject of taxation is income) or 15% (if the subject of taxation is income minus expenses)10.

It should be noted that free of charge receipt by the entity of property is not always recognized by the tax legislation as a non-operating income subject to taxation.

Thus, the income in the form of property received by the Russian entity free of charge is not accounted for determination of the tax base if such income is received from11:

- Authorized (contributed) capital (fund) of the receiving party by more than 50 percent consists of the contribution (shareholding) of the transmitting organization;

- Authorized (contributed) capital (fund) of the transmitting party by more than 50 percent consists of the contribution (shareholding) of the receiving organization;

- Individual, if the authorized (contributed) capital (fund) of the receiving party by more than 50 percent consists of the contribution (shareholding) of that individual.

However, these exceptions are unlikely to apply to this situation.

Speaking about gift, we can not ignore such kind of gift as “donation”.

Donation is a gift of things or rights for generally useful purposes. Donations may be made by citizens, medical treatment facilities, educational institutions, institutions of social protection and other similar institutions, charitable, scientific and educational organizations, foundations, museums and other cultural institutions, public and religious organizations, other non-profit organizations in accordance with the law, as well as state and government entities12.

Thus, donation can not be made to commercial organizations, i.e. in this case, recipient of the project shall be either a citizen or a non-profit organization.

In this case, the transfer of funds as donation must necessarily have a socially useful purpose.

The donation of property to a citizen shall be, and to legal entities may be, determined by the donor by using such property for specific purpose. In the absence of such condition the donation of property to a citizen is deemed a usual donation, while in other cases the donated property is used by the donee in accordance with the purpose of the property.

The legal entity receiving donation, for the use of which a specific purpose is determined, shall keep separate records of all transactions of use of the donated property.

The use of donated property not consistent with the purpose indicated by the donor or for changed purpose, entitles the donor, their heirs or other legal successor, to demand the cancellation of such donation.

-

Sale/provision of services

In this case, when under the terms of the share placed on the crowdfunding platform, the investor that made a financial contribution, may be entitled to receive in the future a thing (disk, books, test sample of manufactured goods), in other words – goods, or to receive a service from the project initiator, we can not speak in such case about donation (let’s recall that a distinctive sign of donation is lack of counter provision).

In this case, the relations between the investor and the project initiator would rather be governed by the RF Civil Code regulating the legal relations of the parties to the sales or service agreement.

Under the sales agreement, one party (the seller) undertakes to transfer the ownership to a thing (goods) to another party (the buyer) and the buyer agrees to accept such ownership and pay for it a certain amount of money (the price)13.

Under the paid service agreement the contractor undertakes, at the direction of the customer, to provide services (perform certain acts or carry out certain activity), and the customer agrees to pay for such services14.

Documentation of the legal relations between the project initiators and the investors by means of legal constructions of sales or service agreements is a fairly common phenomenon. However, once we speak that the project initiator is seller (contractor), and the investor is buyer (customer), in such case the risk of recognition of the crowdfunding platform immediately arises (which collects funds as payment for goods and services sold by project initiators) by the paying agent, which implies the need to comply with certain requirements of the crowdfunding platform.

The activity of paying agents is regulated by the Federal Law no.103- FZ of 03.06.2009 “On activity of receipt of payments of individuals, carried out by paying agents”.

Pursuant to this law, the activity of receipt of payments of individuals means15 receipt by the paying agent from the payer funds for discharge of financial obligations to the supplier as payment for goods (works, services), as well as performance by the paying agent of the subsequent settlements with the supplier.

It is particularly important to note that, despite the fact that according to the aforementioned Law, the paying agent can itself perform settlements with the supplier, in fact, the settlement is different in practice:

- Firstly, contractual relations between the paying agent and the operator of the payment system are required;

- Secondly, for settlements the paying agent shall open a special bank account;

- Thirdly, the funds received from taxpayers shall be collected in the bank servicing the paying agent for further settlements;

- The bank transfers the collected funds to the account of the paying agent;

- The bank makes the payment to service providers.

In order to minimize the above risks, in most cases crowdfunding platforms conclude relevant agreements on settlements with payment systems (Yandex-money, qiwi-purse, Robokassa, etc.).

The requirements of the legislation to the activity of paying agents are addresses in more details below.

In terms of tax legal relations, upon conclusion of the goods sales agreement (service agreement) the tax burden will again largely depend on the hypostasis of the project initiator. If the project initiator acts as individual, the author shall assess and pay taxes at a rate of 13% from the goods (services) obtained from sales. In addition, it should be taken into account that regular profit making from sale of goods (provision of services) shall be taken into account, which evidences that the author of the project is engaged in entrepreneurial activity16, the implementation of which without registration of individual as individual entrepreneur is illegal17.

In case where the initiator acts as a legal entity, the author of the project shall assess and pay from the income received:

- The profits tax at a rate of 20% and the VAT at the rate of 18% (if the entity is registered in the general taxation system), or

- The single tax paid given the use of the simplified taxation system (if the organization uses STS) at the rate of 6% or 15% (depending on the chosen subject of taxation selected by the entity upon passage to the STS.

Also, it shall not be forgotten that when it comes to selling products online, the remote trading of the project initiator is obvious, the performance of which shall be accompanied by observance of certain rules18.

In case of distance sales of goods the retail sales agreement may be concluded on the basis of acquaintance of the buyer with the description proposed by the seller of the goods through catalogues, brochures, booklets, photographs, means of communication (television, mail, telecommunications, etc.) or other means, excluding the possibility of direct acquaintance of the consumer with the goods or samples of goods upon conclusion of such agreement19. In this case, before the execution of the goods sales agreement, the consumer should be provided information on the basic consumer properties of the goods, the address (location) of the seller, the place of production of the goods, the full corporate name of the seller (manufacturer), the price and conditions of purchase of the goods, their delivery, lifetime, expiration date of their lifetime and the warranty period, the procedure of payment for the goods, as well as the term, during which the proposal for concluding the agreement is valid20.

-

Loan

In some cases, funds of investors are raised under the terms of urgency and return, in accordance with which the raised funds shall be returned to investors after a certain period of time. The obligations of the parties arising from the loan agreement are obvious. Under the loan agreement, one party (the lender) transfers the ownership to another party (the borrower) to the money or other things, determined by generic characteristics, and the borrower agrees to repay to the lender the same amount of money (loan amount) or an equal number of other things received by it of the same kind and quality21.

The loan agreement may be non-gratuitous and assume the obligation of the borrower to charge and pay to the lender interests on the loan, or gratuitous – if the loan is interest-free.

The tax burden of the project initiator (the borrower) will be as follows.

Borrower – individual:

- If the loan is interest-free (or if the rate of interest on the loan is less than 2/3 of the refinancing rate set by the RF Central Bank), the recipient of the loan – individual – has a taxable income in the form of material benefit from savings on interests, taxable at the rate of 13%22. The amount of the material benefit from savings on interests is equal to the amount of excess of interests calculated at the rate equal to 2/3 of the refinancing rate of the Bank of Russia, over the amount of interest calculated at the rate established by the loan agreement.

- If the loan is interest-bearing (and the interest rate is more than 2/3 of the refinancing rate), the borrower – project initiator – has no taxable income.

If the borrower is a legal entity, regardless of whether the loan is interest-bearing or interest-free, no tax base for the income tax of the entity is formed23.

The scenario considered assumes presence of the counter obligation of the project initiator to the investors of unconditional return of the loan in the amount of money provided to it, which arises after the period of use of the loan, as well as in other cases stipulated by the loan agreement (demand of early loan repayment).

-

Sale of Shares/Stocks in the Authorized Capital of Entities

This method of raising funds of individuals became very common in foreign practice of establishment and functioning of crowdfunding platforms. The current regulations of the Russian law do not allow implementation of this method of funding for a number of objective reasons.

Number of members

Firstly, the current legislation on limited liability companies established a limit on the number of members. Thus, in accordance with article 7 of the Law on Limited Liability Companies, the number of members of a company shall not be more than fifty. If the number of members of a company exceeds the limit, the company, during a year, shall be transformed into an open joint stock company or a production cooperative. If within this period the company fails to be transformed and the number of members of the company is not reduced to the established limit, it shall be liquidated by court.

This limit does not conform to the principles of organization of activity of crowdfunding platform, according to which the goal of any project initiator is raising funds from as greatest as possible range of individuals, with no limit on the number of members.

In addition, such large number of members of the limited liability company (joint stock company) gives rise to difficulties associated with the arrangement of management of the company’s business.

As is known, the supreme governing body of a company is the general meeting of its members (shareholders)24. Thus, in each particular case for the adoption of all significant business decisions of the company (including decisions on appointment of director, approval of major transactions, increase of the authorized capital, admission to the company of new members) appropriate meeting with adoption of decisions on the issues of agenda by voting of all members will be mandatory.

Need to observe the pre-emptive right to purchase shares of other members

In accordance with the current legislation on limited liability companies, upon sale of share of the member of company, the other members and the company have a pre-emptive right to purchase such share or a part thereof in proportion to their shares (unless the articles of association stipulate otherwise)25.

At the same time, in order to observe this pre-emptive right, the member that intends to sell its share, is obliged to inform in writing the other members and the company about its intention to sell its share, and wait either expiration of thirty days from receipt of such notice by other members, or obtain from others members and the company itself the refusal to use their pre-emptive right to purchase the share put on sale26. In this case, the authenticity of signature on the statement of the member of company or the company itself on refusal to use the pre-emptive right to purchase the share or a part thereof in the authorized capital of the company shall be notarized27.

Need for notarization of signature of new member

In accordance with the applicable law, the transaction aimed at disposal of a share or a part thereof in the authorized capital of the company, shall be notarized. Failure to notarize the transaction entails its voidance28. The share or a part thereof in the authorized capital of the company passes to its buyer upon notarization of transaction aimed at disposal of such share or a part thereof in the authorized capital of the company. After notarization of transaction the notary who notarized it, draws up a notarial deed for transfer to the tax authority of the application for entering the relevant changes to the unified state register of legal entities, signed by the member of the company that disposes of the share or a part thereof.

Therefore to make and document lawfully a transaction aimed at disposing a share (or a part thereof) in the authorized capital of the company, the personal presence of the member – seller of the share and the member – buyer (or the buyer’s representative acting under the power of attorney issued by a notary) is necessarily required.

-

Investment activity aimed at implementation of a specific project

In foreign practice raising funds from investors associated with investment in any project became widespread. That is, in this case, investors pool their money and effort to organize a business (“launch of a start-up project”) aimed at making profits.

If upon entering into a loan agreement investors that provided funds, may rely only on the return of funds and payment of interests on the loan, investors may jointly participate in the profits and generation of income from the business of the created project, depending on the amount of the contribution made by each investor.

The RF civil law have no rules governing this kind of “investment” agreement. However, as provided for by article 421 of the RF Civil Code, citizens and legal entities are free to sign contracts. Parties may enter into a contract both provided for and not provided for by law or other legal acts.

In addition, currently the Law of the RSFSR of 26.06.1991 no. 1488-1 “On Investment Activity in the RSFSR” is effective, which stipulates that investment activity means making investments, or investing, and making set of practical actions related to implementation of investments.

Investments are money, special purpose bank deposits, units, stocks and other securities, technologies, machinery, equipment, loans, other property or property rights, intellectual values, invested in objects of entrepreneurial activity and other types of activity for making profits (generate income) and getting a positive social impact.

The main legal instrument governing the production, economic and other relations of subjects of investment activity is the agreement (contract) between them29. However, the law does not disclose the specifics of entering into and legal regulation of such type of contract.

Thus, by using the analogy of the law, we believe it is theoretically possible the legal relations of investors and the project initiator to be regulated by entering into an investment agreement. However, due to the lack of specific legal regulation of this institution, as well as the lack of court practice related to conclusion of such agreements, we do not exclude the likelihood of problems in the application of this agreement in practice (ex., in terms of the conditions and procedure for determination and calculation of the profits payable to each investor in terms of withdrawal of investor from the project, foreclosure on the share in the project as claimed by creditors of investors, etc.).

Another possible legal manner to regulate the mutual legal relations of investors and project initiator is conclusion of a simple partnership agreement.

Under the simple partnership agreement (joint activity agreement) two or more persons (partners) undertake to combine their contributions and work together without establishing a legal entity to make profits or to achieve other goal, which is not contrary to the law30.

However, the parties to the simple partnership agreement concluded to carry out entrepreneurial activity, can only be individual entrepreneurs and (or) commercial organizations, which significantly limits the use of this type of agreement in the case concerned.

A partner’s contribution may be all that it contributes to the common cause, including money, other property, professional and other knowledge, skills and abilities, as well as business reputation and business relationships31.

Partners’ contributions are assumed to be equal in value, unless otherwise follows from the simple partnership agreement or factual circumstances. The monetary evaluation of the contribution is made by agreement between the partners.

Profits made by partners as a result of their joint activity are distributed in proportion to the value of their contributions to the common cause, unless otherwise provided by the simple partnership agreement or other agreement of partners. The agreement on elimination of any of the partners from participation in profits is void32.

Also important is the fact that at the request of the creditor party to the simple partnership agreement the division of their share in the common property in accordance with article 255 of the RF Civil Code may be made.

Given the fact that party to the simple partnership agreement can not be simple individuals who are not registered as individual entrepreneurs, we believe that the use of this type of agreement is hardly possible in the organization of investment by means of crowdfunding platform.

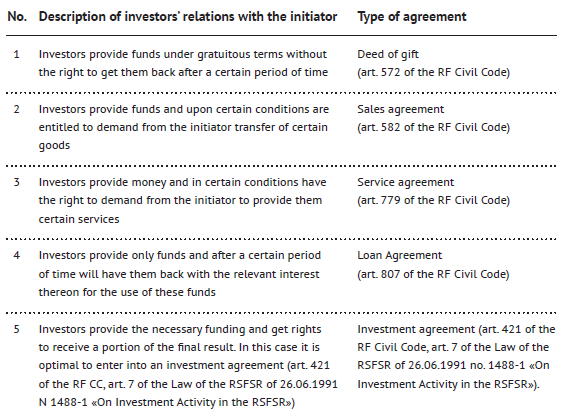

In summary, the existing methods of raising funds of investors can schematically be represented in the table below:

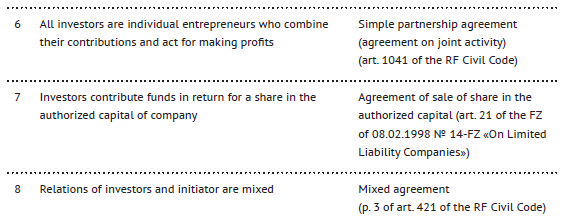

Legal regulation of mutual relations between participants of crowdfunding platform

The most common scheme of relations of participants of crowdfunding platforms can be schematically represented as follows:

Requirements of civil legislation

In order to subdue the relations of participant of the crowdfunding platform to specific unique rules that should guide each member of the crowdfunding platform while using the services of the platform, administrators (founders) of the crowdfunding platform shall be concerned by development of the regulatory and legal framework, which will regulate the interaction of all parties and members, and namely:

- Relations of the crowdfunding platform with platform users (investors and project initiators) – user agreement;

- Agency relations of the crowdfunding platform with the project initiator – agency agreement;

- Relations of crowdfunding platform with payment systems – agreement of activity of payment receipt;

- Relations of investors with project initiator – loan /sales /service agreements, etc.;

- Procedure of personal data processing of platform users – confidentiality clause.

The above regulations may constitute forms of agreements (documents) to be placed on the web-site, where the crowdfunding platform is located (applies to the user agreement, the confidentiality clause), which all users of the crowdfunding platform automatically join upon registration on the web-site in filling in the registration form by placing a “tick” in the appropriate box or are concluded by the crowdfunding platform individually (agency agreement concluded with the project initiator, as well as agreement with payment systems), etc.

The adhesion agreement is an agreement, the terms and conditions of which are defined by one of the parties in the forms or other standard forms and could be accepted by the other party not otherwise than by adherence to the proposed agreement as a whole33.

In this regard, it is reasonable to place on the web-site, where the crowdfunding platform is hosted, the forms approved by the head of the company with the text of the User Agreement, Privacy Regulations and other documents containing a significant part of the required information and conditions of interaction of members (users) of the crowdfunding platform with each other as well as with the platform itself.

In addition, for the relations between the project initiator and investors to be regulated, we also believe it necessary in each particular case to develop an appropriate (loan/sales /service) agreement made accessible to anyone, so that investors to be able to unconditionally adhere to the terms and conditions set out in such agreement.

As to the agreement concluded by the platform with the project initiator, as well as the operators of payment systems, an agency agreement shall be entered into with each initiator, and with the payment system – an agreement for activity related to receipt of payments of individuals.

Under the agency agreement entered into between the platform and the project initiator, the platform will act on behalf of and at the expense of the initiator, receiving and accumulating funds in favor of the initiator, and the initiator will pay to the platform an award determined as a percentage of the total amount of money collected.

Requirements of the Legislation on Personal Data

Under the current RF legislation personal data of an individual include surname, name, father’s name, year, month, date and place of birth, address and other information34. The list of such information is open.

Processing of these data, that is, handling personal data, including collection, systematization, accumulation, storage, clarification (update, change), use, dissemination (including transmission), depersonalization, blocking, destruction, can be carried out only with the consent of subjects of personal data themselves35. Of course the RF legislation provides a closed list of cases where personal data can be processed without the consent of the subject of personal data, but none of these cases can be applied to our situation.

On the contrary, in this case, processing by the crowdfunding platform of personal data of its customers (users, visitors, members) will be carried out, including promotion of products on the market through direct contacts with potential customers by means of communication (email), and therefore such processing is recognized as being carried out without the prior consent of the subject of personal data, until Company proves that such consent was obtained36.

Thus processing of personal data, including their transfer to third parties, received by the platform without the consent of customers will be a violation of the current RF legislation.

Consent of the subject to processing of their personal data

The consent of the subject to processing of personal data is given in written form and must include37:

- The surname, name, father’s name, address of the subject of personal data, number of their main identification document, date of delivery of this document and the issuing authority;

- The name and address of the Company receiving the consent of the subject of personal data;

- The purpose of processing of personal data;

- The list of personal data, the processing of which is consented by the subject of personal data;

- The list of actions with personal data for the performance of which the consent is given, the general description of methods used by the Company for processing of personal data;

- The period during which the consent is valid, as well as the procedure for its revocation.

In the absence of any of the above signs, the clients’ consent to the processing of their personal data should be deemed void. So, obtaining of such consents can not be regarded as a proper fulfilment of the legal requirements to the content of the client’s consent.

Therefore, if the consents of clients to processing of their personal data are given in violation of the content and are invalid, the processing of personal data, including their transmission to third parties, will be a violation of the RF current legislation.

In order to minimize the above risk, the user agreement and the clause of confidentiality shall include the relevant sections containing a clear mechanism defining the procedure for obtaining the consent of subjects of personal data, procedure of processing by the platform of personal data of individuals, as well as methods of processing of personal data for the purpose of which the consent to processing of personal data is obtained.

Liability for violation of the procedure of personal data processing

The persons who violated the legislation on personal data are brought to civil, criminal, administrative, and other liability stipulated by the RF legislation38. At present, the administrative liability of persons who violated the legislation on the procedure of personal data processing of individuals (except those for whom the processing of personal data is a professional activity and is subject to licensing), is provided for the violation of the legal procedure for collection, storage, use or dissemination of personal data. Such violation entails warning or imposition of an administrative fine on officials – from five hundred to one thousand rubles, for legal entities – from five thousand to ten thousand rubles39. At present, the RF Ministry of Economic Development develops a draft of amendments to the RF Code of Administrative Offences, proposing to significantly increase the liability for offences in the area of personal data. In this connection the likelihood that fines for such offences will be significantly increased is not excluded.

If the violation of the procedure of personal data processing was committed by the platform in respect of a number of individuals, an ambiguous situation arises. The arbitration practice on the possibility of bringing the person to administrative liability for violation of the procedure of personal data processing in respect of each individual separately lacks, suggesting that the controversial nature of this issue. However, it should be noted that the practice of our company on protection of interests of the client in cases of administrative offences in the field of protection of consumers’ rights revealed the legal position of inspection bodies, regarding the similar issue related to the violation of the RF legislation on protection of consumers’ rights. So in the course of inspection, officials of the relevant inspection bodies found and made separate minutes on administrative offences, having the same legal components, but made in respect of different consumers.

Given this fact and taking into account the similar principles of the RF legislation on protection of consumers’ rights and the RF legislation on protection of information that guide these legal institutions in the first place to protect the interests of specific individuals, it can be concluded that the violation of the procedure in respect of each individual can be qualified as an independent offence, since in every such case there are all legal components of an administrative offence. When a person commits two or more administrative offences the administrative penalty shall be imposed for each of them40.

Thus, there is a high risk of bringing the crowdfunding platform to administrative liability alone for violation of the procedure of personal data processing, assumed with respect to each individual.

Besides the administrative liability the person who violated the statutory procedure of information processing can be subject to measures of civil and legal liability. Thus, the persons whose rights and legitimate interests were violated by disclosure of restricted information or otherwise misusing it may duly apply for judicial protection of their rights, including with claims for damages, non-pecuniary damages, defamation, protection of honour, dignity and business reputation41.

Legal requirements to paying agents

As we have already stated above, in the case where the crowdfunding platform receives from payer funds aimed at discharge of financial obligations to supplier for payment for goods (works, services), as well as implementation by the paying agent of subsequent settlements with the supplier, in this case, the activity of the crowdfunding platform falls under the activity of payment receipt, carried out by paying agents.

The current RF legislation stipulates the following requirements to the activity of paying agents on payment receipt:

- The obligation of the paying agent to conclude with the supplier of goods (services) an agreement on the activity of receipt of payments of individuals, under which the operator receiving payments (paying agent) may on its own behalf or on behalf of the supplier and on the account of the same receive funds from payers in order to discharge the financial obligations of individual to the supplier and is obliged to carry out subsequent settlements with the supplier as provided for by the agreement and in accordance with the legislation of the Russian Federation42 (including requirement on expenditure of cash received in the cash desk of the legal entity or the cash desk of the individual entrepreneur43).

- The obligation of the supplier to provide on request of the supplier information on paying agents that receive payments in its favor, on places of receipt of payments, as well as the obligation to provide to the tax authorities on their request a list of paying agents that receive payments in its favor, and information on places of payments receipt44.

- The need to ensure the discharge of the obligations of the operator to receive payments to the supplier for the implementation of the relevant settlements with penalty, pledge, retention of debtor’s property, surety, bank guarantee, advance payment, insurance against the risk of civil liability for default on implementation of settlement with the supplier or other means provided for by the agreement on activity of receipt of payments of individuals45.

- The obligation of the paying agent to register with the Federal Service for Financial Monitoring under the procedure approved by the RF Government, as well as duly harmonization of the internal control (the procedure approved by the RF Government Decree of 27.01.2014 № 58)46.

- The obligation of the paying agent to identify the individual payer in accordance with the laws on countering legalization (laundering) of proceeds from crime and terrorist financing47.

- The obligation of the paying agent to use upon receipt of payments cash registers with fiscal memory and control tape, as well as to comply with the legislation of the Russian Federation on use of cash registers upon cash payments48.

- The obligation of the paying agent upon payment receipt to ensure at each place of payment receipt the provision to payers of the following information49:

- Address of place of payment receipt;

- Name and location of the operator receiving payments and payments subagent in the case of receipt of payment by the payment sub-agent, as well as their taxpayer identification numbers;

- Name of the supplier;

- Details of the agreement on activity of receipt of payments of individuals between the operator of payment receipt and the supplier, as well as details of the agreement on activity of payment receipt of individuals between the operator of payment receipt and the payment sub-agent in case of payment receipt by the subagent;

- The amount of fees paid by the payer to the operator of payment receipt and the payment sub-agent in case of payment receipt by the subagent, collection of fees;

- Methods of filing claims;

- Contact telephone numbers of the supplier and the operator of payment receipt, and the payment subagent in case of payment receipt by the same;

- Addresses and contact telephone numbers of federal executive bodies authorized by the Government of the Russian Federation to carry out state control (supervision) over the payment receipt.

8. The obligation of the payment of agent upon receipt of payment to use a special bank account (s) for settlements50.

9. The obligation of the paying agent to deliver to the credit organization the cash received from taxpayers upon receipt of cash payments to be credited in full to its special bank account(s)51.

10. The possibility to perform with the special bank account of the paying agent of the exhaustive list of operations and namely:

- Crediting of cash received from individuals;

- Crediting funds withdrew from another special bank account of the paying agent;

- Withdrawal of funds to a special bank account of the paying agent or supplier;

- Withdrawal of funds to bank accounts.

In this case, other operations with a special bank account of the paying agent are prohibited.

Besides, the Government of the Russian Federation established a list of goods (works, services), for the payment of which the paying agent shall not be entitled to receive payments of individuals52. These include:

- Reception of lottery bets, except for the all-Russian state lotteries held in real time;

- Reception of payments for lottery tickets, bills and other documents certifying the right to participate in the lottery;

- Reception of bets for participation in gambling.

Due to the fact that the crowdfunding platform for the implementation of the activity related to receipt of funds from individuals as payment for goods/works/services sold by the project initiator will involve payment systems, the risk of recognition of the platform crowdfunding as paying agent reduces.

Possibility to use funds of investors until the end of collection

As a rule, the terms and conditions of collection of funds under a specific project provides for the obligation of the platform to transfer to the project initiator the amount collected only if the required amount claimed by the project initiator, was collected within the specified time period. In fulfilling this condition all collected funds are returned to investors.

In this connection, a question arises – whether the crowdfunding platform is entitled to use funds on its account until the moment it is obliged to transfer the funds collected to the initiator (if the full amount was collected) or to investors (in case where within the prescribed period it failed to collect the funds) or not.

In our opinion, in this situation, there is an objective possibility of using the funds collected by the platform, taking into account the following circumstances:

- It should be understood that there is no legal basis for the use by the platform of funds, so the platform must be ready at any time upon one of the above circumstances, to transfer funds to the initiator or investors. Otherwise, these persons have the right to sue the platform for recovery of debt and interests accrued on other persons’ money53. To at least somehow “legitimize” the use by the platform of money received from individuals, until their transfer to the initiator, the appropriate possibility shall be provided in the agency agreement between the platform and the initiator.

- If the relations between investors and project initiator are mediated by the sales/service agreement, the use by the platform of funds collected for the initiator may be limited due to the requirements of the legislation on paying agents (limit for operations with the special account of the paying agent) as described above.

- Point 1 article 6 of the RF Civil Code.

- Point 2 article 6 of the RF Civil Code.

- Point 1 article 572 of the RF Civil Code.

- Article 128 of the RF Civil Code.

- Point 1 article 574 of the RF Civil Code.

- Article 575 of the RF Civil Code.

- Point 18.1 article 217 of the RF Tax Code.

- Point 8 article 250 of the RF Tax Code.

- point 1 article 284 of the RF Tax Code.

- Article 346.20 of the RF Tax Code.

- Sub-point 11 point 1 article 251 of the RF Tax Code.

- Point 1 article 582 of the RF Civil Code.

- Point 1 article 454 of the RF Civil Code.

- Point 1 article 779 of the RF Civil Code.

- Point 1 article 3 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 1 article 2 of the RF Civil Code.

- Point 1 article 23 of the RF Civil Code, article 14.1 of the RF Code on administrative offences, article 171 of the RF Criminal Code.

- Rules of remote sale of goods are approved by the RF Government Decree of 27.09.2007 no. 612.

- Point 2 article 497 of the RF Civil Code; point 1 article 26.1. of the RF Law of 07.02.92 no. 2300-I “Consumer Rights Protection”.

- Point 8 of the Rules of distance trade.

- Point 1 article 807 of the RF Civil Code.

- Sub-point 1 point 2 article 212 of the RF Tax Code.

- Letters of the RF Ministry of Finance of 02.04.2010 no. 03-03-06/1/224, of 14.07.2009 no. 03-03-06/1/465, of 20.05.2009 no. 03-03-06/1/334, of 17.03.2009 no. 03-03-06/1/153.

- Article 32 of the Federal Law of 08.02.1998 no. 14-FZ “On Limited Liability Companies”; article 47 of the Federal Law of 26.12.1995 no. 208-FZ “On Joint Stock Companies”.

- Point 4 article 21 of the Federal Law of 08.02.1998 no. 14-FZ “On Limited Liability Companies”.

- Point 5 article 21 of the Federal Law of 08.02.1998 no. 14-FZ “On Limited Liability Companies”.

- Point 6 article 21 of the Federal Law of 08.02.1998 no. 14-FZ “On Limited Liability Companies”.

- Point 11 article 21 of the Federal Law of 08.02.1998 no. 14-FZ “On Limited Liability Companies”.

- Point 1 article 7 of the Law of RSFSR of 26.06.1991 no. 1488-1 “On investment activity in the RSFSR”.

- Point 1 article 1041 of the RF Civil Code.

- Article 1042 of the RF Civil Code.

- Article 1048 of the RF Civil Code.

- Article 428 of the RF Civil Code.

- Sub-point 1 article 3 of the Federal Law of 27.07.2006 no. 152-FZ “On personal data” (hereinafter– Law on personal data).

- Point 1 article 6 of the Law on personal data.

- Point 1 article 15 of the Law on personal data.

- Point 4 article 9 of the Law on personal data.

- Article 24 of the Law on personal data.

- Article 13.11 of the Code of the Russian Federation on administrative offences.

- Part 1 article 4.4 of the Code of the Russian Federation on administrative offences.

- Article 17 of the Federal Law of 27.07.2006 no. 149-FZ “On information, information technologies and information protection”.

- Point 1 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- In accordance with this requirement, cash received by legal entities that are not credit institutions, from individuals as payments to other persons in cases covered by the relevant legislation of the Russian Federation can not be spent by the payment agent, and shall be given in full to cash desks of credit institutions (point 2 of Indication of the Bank of Russia of 20.06.2007 no. 1843-U “On limiting amount of cash settlements and expenditure of cash incoming to the cash desk of the legal entity or cash desk of individual entrepreneur).

- Point 3 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 4 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 5 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 6 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 12 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 13 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 14 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Point 15 article 4 of the Federal Law of 03.06.2009 no. 103-FZ “On activity of receipt of payments of individuals carried out by payment agents”.

- Approved by the RF Government Resolution of 15.11.2010 no. 920.

- Article 395 of the RF Civil Code.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download