- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

FAQ on Cyprus

Non-domiciled tax resident of Cyprus: why and how?

Why would one want to become a tax resident of Cyprus?

Before spending time on studying the theory, practice, and even more so, on monitoring changes in the Cyprus tax legislation, the first things you need to do is to decide whether you need it at all.

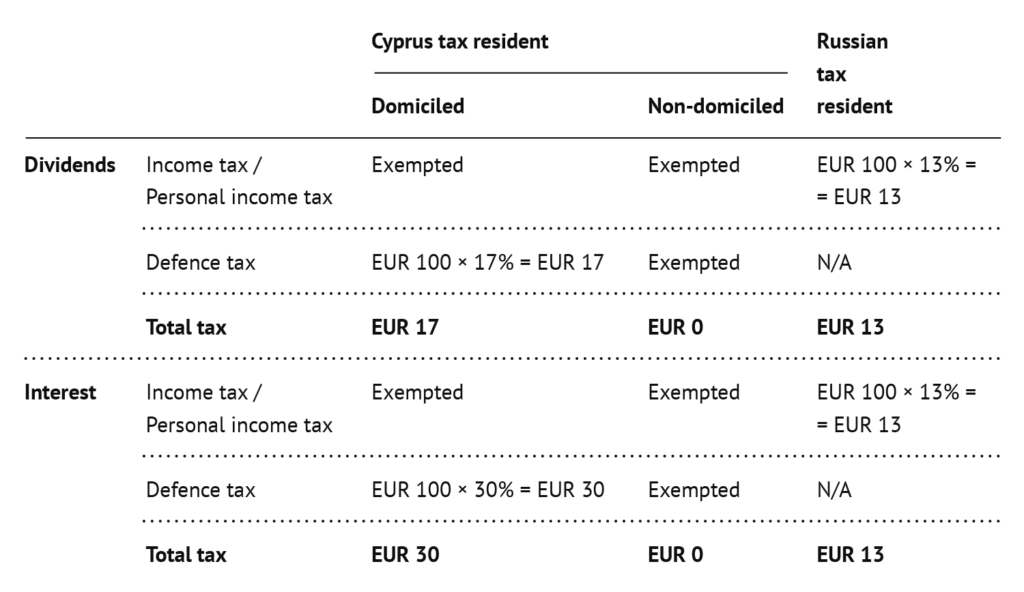

The question why it is particularly important to become a non-domiciled tax resident is answered in the table below. It shows tax effects for Russian tax residents and Cyprus tax residents, both domiciled and non-domiciled.

The table shows tax effects of receiving income in the form of dividends / loan interest in the amount of, for example, EUR 100 from a Hong Kong company.

Thus, tax savings of non-domiciled tax residents of Cyprus is obvious. However, it should be pointed out that the table shows tax effects only for passive income, namely dividends and passive interest income (i.e. preferential tax treatment does not apply to all types of income).

Therefore, when making a decision on one’s tax residency, one should take into account tax effects for all types of income, including tax effects at the source of income payment, since some jurisdictions have provided for an increased personal income tax rate for certain types of income paid by Russian tax residents in favor of foreign tax residents. For example, when receiving a salary from a Russian company, an employer as a tax agent will have to withhold personal income tax at an increased rate of 30% of the salary paid to a foreign (in our case, Cyprus) tax resident.

How could one become a non-domiciled tax resident of Cyprus?

Amendments to the tax legislation providing for the introduction of a new test for determining the tax residence of individuals (“60-day rule”) were adopted in mid-2017. The amendments have become effective retrospectively since January 1, 2017 and have been applied since the 2017 tax period (in Cyprus a tax period coincides with a calendar year).

Once the “60-day rule” becomes effective, an individual shall be considered a tax resident of Cyprus if he/she complies with one the following criteria: the existing “183 days” criterion or the new “60-day rule” during the tax period.

The “60-day rule” applies to individuals for whom all of the following conditions were met simultaneously during the current tax period:

- They have not been in any other country for a period exceeding 183 days in total;

- They are not tax residents of any other country;

- They have been in Cyprus for at least 60 days;

- They have other connections with Cyprus (they own / rent a place of residence during a long period of time and have business or are employed in Cyprus).

An individual tax resident of Cyprus shall be exempt from taxation in Cyprus in respect of worldwide income (whether derived from sources in Cyprus or from other jurisdictions) in the form of dividends and “passive” interest income, if for tax purposes such an individual is not considered to be permanently resident in Cyprus.

An individual who has no “domicile by birth” in Cyprus (Domicile of Origin) shall be recognized for tax purposes as a permanent resident of Cyprus, in case the individual was considered a tax resident of Cyprus for any 17 years out of the 20 years preceding the current tax period. The concept of “Domicile of Origin” shall be assigned at the time of birth and it usually corresponds with the domicile of the father at the time of the child birth, and in exceptional cases – with the domicile of the mother.

It should be noted that applying the “60-day rule” is more of an opportunity allowing to apply a preferential tax treatment, while living in Cyprus for 60 days or more does not automatically make an individual a non-domiciled tax resident of Cyprus.

Legislation on controlled foreign companies in Cyprus

On April 5, 2019, the Parliament of the Republic of Cyprus approved the law on the introduction of the provisions of EU Directive 2016/1164 (Anti-Tax Avoidance Directive) to the national tax legislation. The law will apply to tax periods starting from January 2019.

This Directive requires, inter alia, that countries with no provisions on controlled foreign companies in their national tax legislation shall adopt such provisions and bring them into effect by 01.01.2019.

It should be noted that regulations on controlled foreign companies apply only to Cyprus corporate taxpayers, i.e. only a Cyprus company, but not an individual, may be recognized as a controlling person.

In accordance with the law a foreign legal entity or a permanent establishment of a Cyprus company shall be recognized as controlled subject to the following conditions:

- The ownership share of a Cyprus company in a foreign legal entity directly or indirectly amounts to at least 50%;

- The effective income tax rate at which a foreign company or a permanent establishment pays taxes amounts to less than 50% of the amount of taxes that would be paid by a Cyprus company at its current income tax rate.

If a foreign legal entity or a permanent establishment of a Cyprus company is recognized as controlled, the tax base of the Cyprus company shall include retained earnings of the controlled foreign company.

Transfer pricing in Cyprus

On June 30, 2017, the Cyprus tax authorities issued the Circular that introduced new provisions for financial transactions between related parties (intra-group financial transactions) subject to transfer pricing standards (TP). New provisions became effective on July 1, 2017 and generally cover the arm’s length principle set in accordance with TP recommendations stipulated by the Organization for Economic Co-operation and Development. The Circular applies to both current and future intra-group financial transactions.

The arm’s length principle is not new for Cyprus. It has been since 2003, that in order to harmonize with the provisions of Article 9 of the OECD Model Convention, Cyprus has an active provision of Article 33 of the Income Tax Law, which stipulates that all transactions between interdependent persons shall follow the arm’s length principle.

The OECD has provided its definition for the arm’s length concept, and it means the following: all transactions between interdependent persons shall be carried out on market conditions, as if the parties were independent of each other and acted in accordance with their own interests only. It is important that this principle, as well as the provisions of Article 33 of the Income Tax Law, shall apply to any transactions between related parties. Therefore, according to the law, it has been since 2003 that related companies in Cyprus have been obliged to offer each other their goods and services, as well as to provide loans based on market conditions.

With the release of the Circular, companies shall not only comply with the arm’s length principle, but also prepare a background statement for the selected interest rate and margin of the transaction and submit it to the tax authorities. Such analysis prepared by independent experts shall be mandatory for all intra-group financial contracts, regardless of the name the parties give to such a contract, since the above-mentioned circular further emphasizes that the actual behavior of participants to the transaction and its economic substance prevail over formal agreements of the parties.

According to the new Circular, in order to accurately determine an intra-group financial transaction, it is necessary to determine its characteristics, such as terms and functions, assets used, and risks assumed by related parties.

Once an intra-group financial transaction is accurately determined, the price shall be analyzed for compliance with the arm’s length principle by comparing it to compatible transactions in the market at the time of the intra-group financial transaction, and taking into account the price that would be agreed by independent parties in a compatible transaction in the market under similar conditions (“compatibility” adjustments are possible, but they should meet internationally recognized standards).

At the same time, if a taxpayer carries out only intermediary activities for providing loans or cash advances to related parties, which in turn are financed by loans or cash advances from related parties, then simplified measures may be applied. When using “simplified measures”, intra-group financial transactions shall be recognized as compliant with the arm’s length principle if the return on assets net of tax amounts to at least 2%. This indicator shall be regularly reviewed by the Cyprus tax authorities. It is assumed that no TP analysis is required for the implementation of “simplified measures”. However, a deviation of the minimum return on assets net of tax of 2% is possible only in case of an appropriate TP analysis, which confirms the marketability of such a deviation. The use of “simplified measures” by taxpayers should be reflected in the taxpayer’s annual tax return.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download