- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

There is no profit but there are taxes

Accounting profit is arguably one of the main indicators of financial position of an organization. However, information about it does not make it possible to get an idea of the amount of income tax. Accounting profit includes all income and expenses of a company without exception, not taking into account any peculiarities of tax laws of the country of incorporation of the company.

Tax profit shall be understood to mean the difference between income and expenses which forms the tax base. Tax profit can be fundamentally different from accounting profit. A simple example for a Cyprus company is dividends received or profit from sales of securities which make it into accounting profit but not into tax profit.

In this article, we will consider situations that are not so obvious but occur quite often, like when a company incorporated in Cyprus has differences between accounting profit and tax profit.

1.As in many other jurisdictions, Cyprus has a rule under which expenses not related to generating income (note: taxable income) are not taken into account in calculation of corporate income tax. Such expenses particularly include rental costs for premises/equipment the use of which is not related to activities of a company. Another example is broker’s fee for transactions on sale and purchase of securities. Since profit from sales of securities is exempt from taxation, expenses will not be taken into account when calculating the tax base.

2.The next difference that occurs in activities of virtually any company concerns exchange differences. They are realized and unrealized.

Realized exchange difference is exchange difference arising as a result of changes in exchange rates in the course of a certain transaction (currency conversion, repayment of debts/credits/loans/interest on loan obligations denominated in foreign currency, etc.).

Unrealized exchange difference is exchange difference arising in revaluation of funds in foreign currency accounts, assets and liabilities under contracts entered into in foreign currency at the end of the reporting period.

All unrealized exchange differences, both positive and negative, are excluded from the tax base in tax calculation.

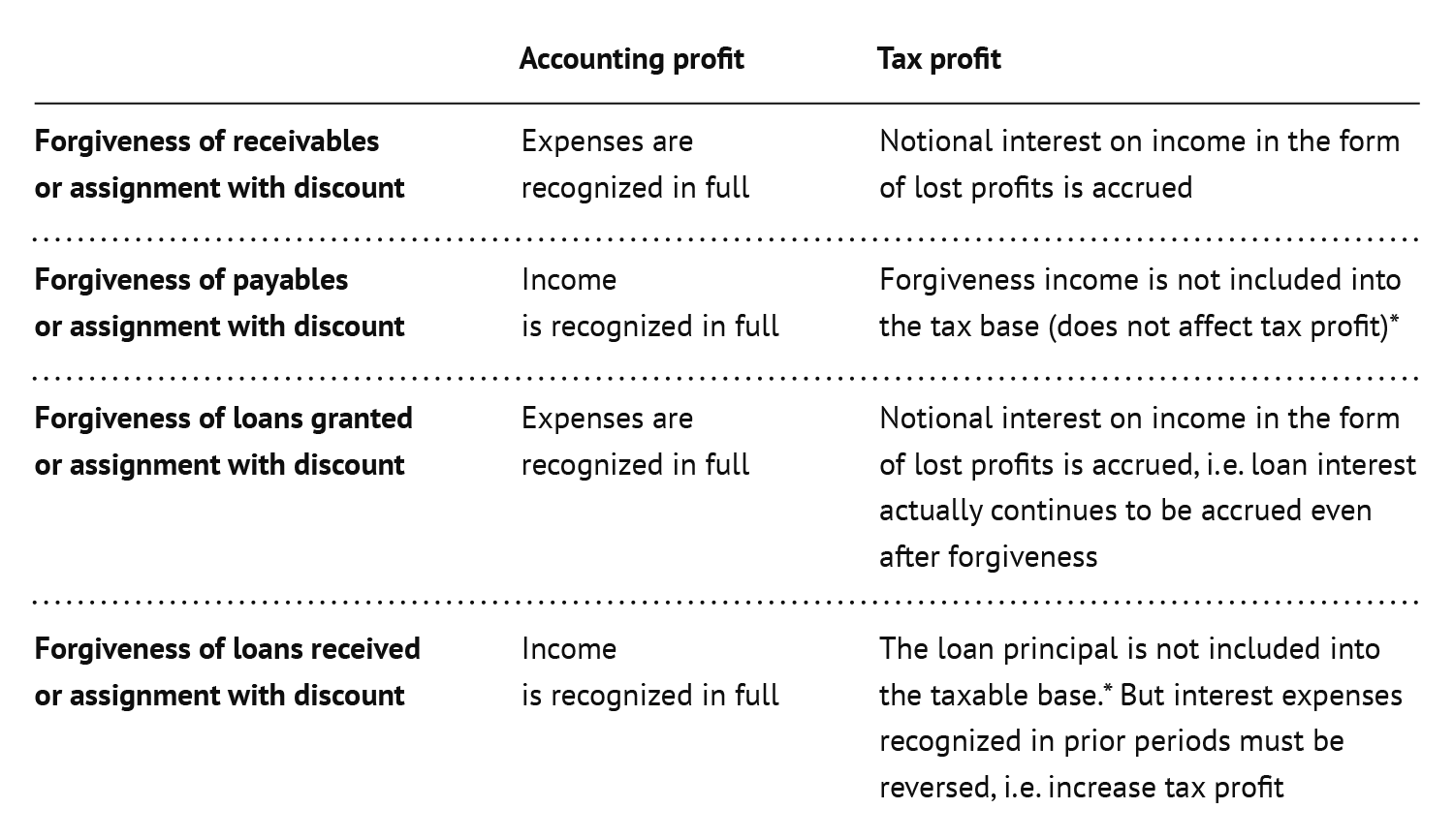

3. Differences in calculation of accounting and tax income are also caused by transactions concerning forgiveness of debts and loans in full or in part, both granted and received. These transactions usually arise between related parties.

Accrual of so-called notional interest is associated with adherence to the arm’s length principle set forth in Article 33 of the Income Tax Law 2002.

In the event of financing/provision of loans to related parties, transactions must be made at arm’s length. Otherwise, Cyprus tax authorities reserve the right to introduce tax adjustments to reflect deviations from this principle. This is usually done in the form of notional interest and/or waiver of certain interest expenses.

That is, when the conditions of two related companies in their commercial or financial relations differ from those of independent parties, any profit that should have been accrued (provided that the same conditions are applied as those of independent parties) can be included into the company’s profit and be taxed with corporate tax at the rate of 12.5% accordingly.

For companies whose primary activities are receipt and provision of loans, the fact of excess of interest expenses over interest income would be considered suspicious. It is worth mentioning the loan interest limitation rule (exceeding borrowing costs, EBC). On April 25, 2019, the Law 63(I)/2019 on implementation of the EU Anti-Tax Avoidance Directive (ATAD) 2016/1164 came into force in Cyprus. Under this rule, excessive borrowing costs are deductible in the amount of up to 30% of EBITDA (Earnings before interest, taxes, depreciation and amortization). The said rule has a number of exceptions, namely:

- A minimum threshold has been set (excessive borrowing costs of up to 3 million euros can be deducted);

- The rule does not apply to loans issued before June 17, 2016 and other loans.

4. Receivables that remain outstanding for several reporting periods often lead to additional tax charge.

According to IFRS (International Financial Reporting Standards), it is important to adhere to the concept of time value of money. Obviously, 5 million rubles now and 5 million rubles in 3 years’ time is not quite the same amount. Therefore, if a company has receivables and takes no action get its money back for several years, it is not about the receivables but about financing received, most likely, from a related party, i.e. an interest-free loan.

In this case, it would be right to discount 5 million rubles, that is, calculate the equivalent amount at the time being and reflect financial income each year in the same manner as if an interest loan were issued. In this case, there is no difference between accounting profit and tax profit.

However, this approach is unpopular in practice. Company management cites a lack of information on maturities and professional judgment. Still, there is no way to avoid recognition of income in Cyprus. In the event of an audit, the auditor or tax authorities accrue notional earnings. That is, financial income will not be recognized in accounting profit but will be included into tax profit based on the same arm’s length principle.

It is possible to avoid the accrual of notional interest if evidence is provided that the debt is defaulted (not recoverable) according to the classification from IFRS 9 Financial Instruments.

It is mentioned in the standard that accountants can use their professional judgment, however, in practice, the auditor and tax authorities request a court ruling or other documents confirming bankruptcy/liquidation of the debtor in English or in Greek.

Until the asset is recognized as defaulted, it is necessary to accrue financial income whether it is a “hung” receivable or a loan. If there are no supporting documents, bad debt provision which reduces accounting profit but does not affect the tax base shall be recognized in accounting.

Thus, the lack of profit in accounting does not guarantee that a company will not have tax liabilities, and vice versa. The company may have both large accounting profit and tax loss. To avoid any unpleasant surprises in preparation of financial statements, it is very important to understand the impact of a business transaction on taxable profit in view of nuances of tax legislation.

*- according to audit and judicial practice, not fixed at the legislative level

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download