- Cyprus Citizenship Scheme for Foreign Investors

- Squeezed But Pleased: Taxation of Passive Income in the European Union

- VAT Without Borders or Window to Europe

- Legal Aspects of Organization of Operation of Crowdfunding Platforms in Russia

- Substance Requirements in Tax Planning Structures

- “Deposit Splitting” of Individuals. Legal Civil and Criminal Aspects

Overview of Recent Court Decisions Related to the Application of the Concept of the Beneficial Owner of Income

Legal cases in which courts have focused on the qualification of the beneficial owner of income have increased significantly in recent years and in most cases have become a rule rather than an exception.

In May 2019, the Federal Tax Service summarized the law enforcement practice in disputes in which the tax authorities established that international agreements had been abused.

In particular, the concept of “person beneficially entitled to income (beneficial owner)” is widely used as a universal instrument to combat abuse.

This concept is based on the prohibition of granting exemption from withholding tax when a foreign company receiving the income acts as a frontman for another person who is actually the beneficial owner of income.

In this article, we propose to analyze some of the court decisions of supreme courts, which have become the most representative in recent years.

Case of Credit Europe Bank CJSC

Ruling No. 526-О of the Constitutional Court of the Russian Federation dated 27.02.2018 on refusal to accept complaints of Credit Europe Bank CJSC for consideration. Structure of business operations (fig. 1).

Factual allegations

The Russian bank paid interest on the deposits placed by the Swiss (“sister”) bank at the reduced rate (5%) under the double tax agreement. In fact, the Swiss bank placed funds on deposits for the benefit of its clients.

Content of the decision

In the case in point, the courts have concluded that beneficial owners of the disputed interest have been individuals (investors) other than the Swiss bank. Therefore, the preferential rate under the agreement (5%) could not have been applied, and the general rate of 20% should have been applied.

- The courts (tax authorities) paid attention to the following facts:

- The Swiss bank had no actual right to income (as it acted as an agent for deposits);

- Lack of information on particular beneficial owners of the disputed interest (their residence).

Case of Krasnobrodsky Yuzhny LLC

Ruling No. 304-КГ18-22775 of the Supreme Court of the Russian Federation dated 18.01.2019 in case No. A27- 331/2017 of Krasnobrodsky Yuzhny LLC to Interdistrict Inspectorate No. 3 of the Federal Tax Service of the Russian Federation for the Kemerovo Region, Ruling No. 304- КГ17-17349 of the Supreme Court of the Russian Federation dated 25.12.2017 in case No. A27-20527/2015, Ruling No. 304- КГ17-19528 of the Supreme Court of the Russian Federation dated 25.12.2017 in case No. А27- 16584/2016. Structure of business operations (fig. 2).

Factual allegations

The Russian LLC paid dividends in favour of its shareholder (Cyprus company) at the reduced rate (5%) subject to the provisions of the double tax agreement.

Content of the decision

In the case in point, the courts have concluded that none of the Cyprus companies operates in Cyprus, and therefore, the Cyprus company (LLC member) is a conduit company, not the beneficial owner of income.

Therefore, the preferential rate under the agreement (5%) cannot be applied.

The courts (tax authorities) paid attention to the following facts:

- The Cyprus company does not dispose of the funds received as dividends in full (net of current administrative expenses);

- Further reallocation of dividends to other founders (Cyprus, BVI);

- One of the further founders also registered in the territory of the Republic of Cyprus does not carry out financial and economic activities and reallocated dividends received in full (net of current administrative expenses) further to its founders, which indicates that none of the entities under the jurisdiction of the Republic of Cyprus carried out actual business activities;

- There were no transactions defining the business activities of the Cyprus company;

- Independent auditor’s reports, according to which the Cyprus company depends on the constant financial assistance of its shareholders, without which there would be a debt, which would not allow the companies to continue as a going concern and fulfil their obligations on the current activities.

Case of Rusjam Steklotara Holding LLC

Ruling No. 301-ЭС19-2319 of the Supreme Court of the Russian Federation dated 25.04.2019 in case No. A11-9880/2016 of Rusjam Steklotara Holding LLC to the Interdistrict Inspectorate of the Federal Tax Service for the largest taxpayers in the Vladimir region. Structure of business operations (fig. 3).

Factual allegations

The Russian LLC paid dividends in favour of its shareholder (Dutch company) at a reduced rate (5%) under the agreement.

Content of the decision

The courts have established that the company, which is a resident of the Netherlands, is not the beneficial owner of the dividends paid by the company; it is only an intermediate (technical) link and is not the ultimate beneficiary of the income received on its account, which is transferred in transit to the address of two entities registered in Turkey. The Turkish company (ultimate shareholder) has been recognized as the ultimate beneficiary.

The courts (tax authorities) paid attention to the following facts

When considering the dispute over this case, the courts paid attention to the following circumstances:

- Dutch tax authorities have provided information that the Dutch company acts as an intermediate holding and investment company;

- Average staff number of the Dutch company is 0 persons;

- The company, which is a resident of the Netherlands is only a member of the company;

- The director of both the company, which is a resident of Turkey and the company, which is a resident of the Netherlands, is the same individual;

- Activities of the Dutch company and other companies as part of the fund’s transfer have been controlled by the Turkish holding company;

- According to the financial statements of the Dutch company for 2012–2013 (submitted by the Dutch tax authorities), the only income of the company is dividends from the company, and the fixed assets are the shareholders’ funds, which serve as a source for the formation of the company’s share capital;

- In 2011–2012, the company incorporated in the Netherlands paid no taxes due to the carry forward of losses of previous years; in 2013, it recorded the minimum taxes to be paid; in 2014, it recorded no taxes to be paid, as well as the dividend income for 2014;

- According to the settlement account statement of the company, which is a resident of the Netherlands, all dividends received from the company were transferred within a few days to the accounts of foreign companies which have no direct participation interest in the company.

Case of Polosukhinskaya Mine OJSC

Ruling No. 304-КГ18-19526 of the Supreme Court of the Russian Federation dated 03.12.2018 in case No. A27- 27287/2016 of Polosukhinskaya Mine OJSC to Interdistrict Inspectorate No. 2 of the Federal Tax Service of Russia for the largest taxpayers in the Kemerovo region. Structure of business operations (fig. 4).

Factual allegations

The Russian LLC paid dividends in favour of its shareholder (Dutch company) at a reduced rate (5%) under the agreement.

Content of the decision

The court has concluded that formal conditions (for example, the residence of the counterparty) for the possibility of using the double tax agreement for the main purpose of obtaining tax benefits alone indicate the misuse of this agreement and entail a reasonable refusal to provide tax benefits. When considering the dispute over this case, the courts paid attention to the following circumstances:

- Dividends have been transferred in transit to the entities registered in the British Virgin Islands;

- The Cyprus companies have been incorporated as formal owners of the company and had no funds to acquire the company’s shares, therefore, they could not invest in the share capital;

- The only transaction made by the Cyprus companies was a transit transfer of funds through the “chain” of shareholders.

Case of Melnik JSC

Ruling No. 304-КГ18-25280 of the Supreme Court of the Russian Federation dated 18.02.2019 in case No. A03- 21974/2017 of Melnik JSC to the Interdistrict Inspectorate of the Federal Tax Service of Russia for the largest taxpayers of the Altai territory. Structure of business operations (fig. 5).

Factual allegations

The Russian LLC paid dividends to its sole shareholder, which is a foreign company, disguised as the transaction to redeem its own shares under the securities sale and purchase agreement.

Content of the decision

The court has concluded that, as a result of the above actions, a part of the profit has been withdrawn in favour of a foreign legal entity, while the scope of rights of the foreign company in relation to the company has not changed. And since the payment of passive income (dividends) has taken place in this case, the Company should withhold tax.

The courts (tax authorities) paid attention to the following facts:

- The company has had significant retained earnings and has paid no dividends to its shareholders for several years;

- A foreign company has become the shareholder of the company shortly before disputable transactions were made (with the share of 99.86%, subsequently 100%);

- Immediately after the conclusion of the share sale and purchase agreement, the foreign company opened a bank account with the bank which is a resident of the Republic of Latvia, to which the funds were transferred with the comment “redistribution of funds within the holding”;

- The Court of Appeal annulled the decision of the Court of First Instance on invalidation of the decision of the tax authority, and concluded that, as a result of the above actions, a part of the profit has been withdrawn in favour of a foreign legal entity, while the scope of rights of the foreign company in relation to the company has not changed;

- The foreign company, which is the sole shareholder of the taxpayer during the audited period, had limited powers with respect to the disposal of the income received;

- There were no transactions defining business activities;

- The foreign company obtained no benefit from the income and had no saying in defining its future economic fate;

- Coordination of actions between the taxpayer and its sole shareholder.

Case Active Rus LLC

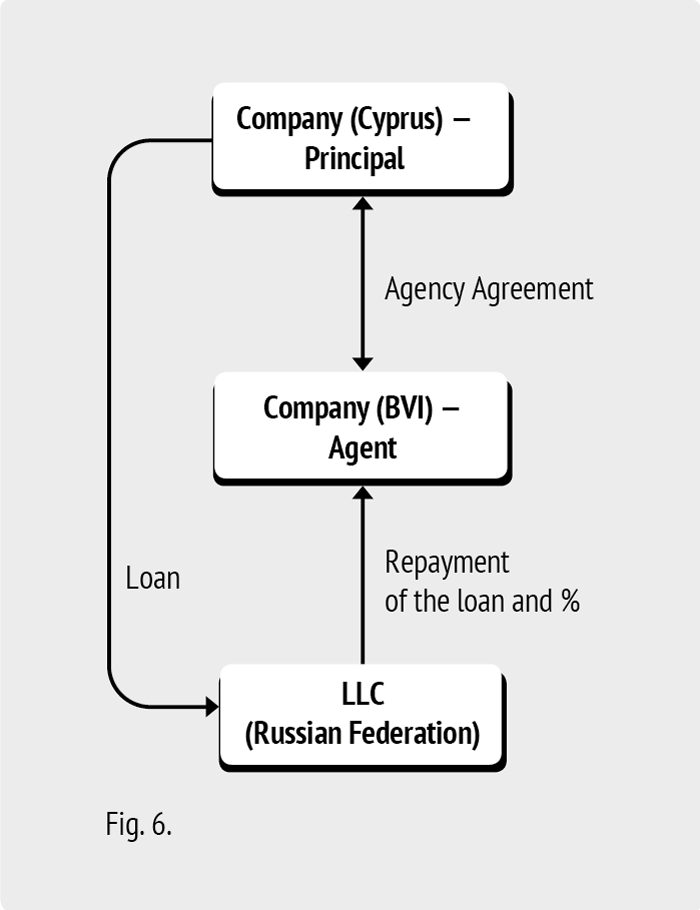

Ruling No. 310-КГ18-15460 of the Supreme Court of the Russian Federation dated 15.10.2018 in case No. A62- 3777/2017 Active Rus LLC to Interdistrict Inspectorate No. 6 of the Federal Tax Service of Russia for the Smolensk region. Structure of business operations (fig. 6).

Factual allegations

The Cyprus company granted a loan to the Russian company. The loan and accrued interest were repaid on behalf of the Cyprus company to the account of a third party, which is a company registered in the BVI.

According to the taxpayer’s legend, the BVI company is the paying agent of the Cyprus company, which is responsible for keeping the client’s funds on the agent’s account, managing the current account and making payments to third parties.

Content of the decision

Activities of the Cyprus company has been recognized as technical. The company registered in the BVI has been recognized as the beneficial owner of income.

When considering the dispute over this case, the courts paid attention to the following circumstances:

- Proof of the fact that related parties have created the scheme aimed at obtaining unjustified tax benefit by the company;

- Absence of reliable evidence that the Cyprus company has qualified the disputed interest as its own received income and recorded it in the financial statements;

- According to the information from public sources, the Cyprus company is an industrial company, there is no data on its financial profile and audit, there is no information on its shareholders and there is no information on the subsidiaries of this company;

- Cyprus company’s activities are of technical nature, the Cyprus company does not carry out activities other than receiving and transferring funds from taxpayers, and the direct beneficiary is an offshore company registered in the British Virgin Islands;

- Under the notice to the Cyprus company, the company has transferred funds to a resident of the British Virgin Islands in payment of the loan and the interest thereon under the financial services agreement. The funds have been transferred to the bank account opened in Israel. No funds have been received in the Republic of Cyprus.

Case of Vladimir Energy Retail Company PJSC

Ruling No. 301-КГ17-18409 of the Supreme Court of the Russian Federation dated 14.12.2017 in case No. A11- 6602/2016 of Vladimir Energy Retail Company PJSC to the Interdistrict Inspectorate of the Federal Tax Service for the largest taxpayers in the Vladimir region. Structure of business operations (fig. 7).

Factual allegations

The CJSC (Russian Federation) was the sole member of the Russian company. The specified share was transferred to the ultimate buyer, which is also a Russian company, not directly, but through inclusion into the flow of operations of the Cyprus company.

Content of the decision

The activities of the Cyprus company have been recognized as technical.

The company registered in the BVI (the sole shareholder of the Cyprus company) has been recognized as the beneficial owner of income. The courts (tax authorities) paid attention to the following facts:

- The Cyprus company was a “technical” (conduit) entity and was not the beneficial owner of income from the transaction with the company, but acted only as a transit link for the acquisition and subsequent sale of the share in the authorized capital of the Russian entity with the purpose of obtaining the relevant preferences in the Russian Federation and the Republic of Cyprus;

- Actions for the transfer of ownership to 100% share in the authorized capital of the Russian entity from the original owner (closed joint-stock company) to the ultimate recipient (company) were carried out within a short period of time without an objective need to make transactions through a non-resident Cyprus company with the characteristics of a “technical” entity;

- Affiliation of the transaction parties.

Cases on the dispute between T Danmark, Y Denmark and the Danish Tax Ministry

The decision of the Court of Justice of the European Union dated 26.02.2019 in joint cases C116/16 and C117/16 on the dispute between T Danmark, Y Denmark, and the Danish Tax Ministry. <1>

Main conclusions of the Decision of the European Court of Justice:

- A group of companies may be considered a technical structure if the circumstances of its establishment do not correspond to the economic reality and the main purpose of its establishment is to obtain tax preferences set by the tax system of the respective state;

- Circumstances confirming that the company acts as a conduit are that the only activities of the company are the receipt of dividends and their reallocation to the beneficial owner or another conduit company;

- Absence of actual economic activities of the company may be determined after analyzing all factors of the company’s activities, including company’s management procedure, reporting, the structure of income and expenses, number of the company’s employees, amount of fixed assets;

- Artificiality of legal relations may be evidenced by the fact that within the group of affiliated companies activities are structured in such a way that the company receiving the dividends shall reallocate these dividends to a third company which does not meet legal requirements due to the fact that it has a minor tax profile and its only activity is the transfer of funds to the beneficial owner of income;

- In order to recognize a person as the non-beneficial owner of income or to establish the fact of abuse, tax authorities do not need to identify the person(s) who is (are) the beneficial owner (s) of income.

Summary

The review of the most recent court decisions taken by the supreme courts shows that:

- The practice of courts related to the application of the concept of the beneficial owner of income has not changed. Courts (as well as supervisory authorities) continue to pay due and close attention to this issue;

- No new circumstances/indicators/ evidence, which tax inspectors and courts rely on when investigating the issue of qualification of a foreign entity as the beneficial owner of income (compared to previous court decisions and letters of the Ministry of Finance) has appeared;

- Most of the cases relate to the period of 2011–2015, i. e. the period when due court practice on these issues has not yet been formed, and taxpayers paid no due attention to the issues of documenting the form and content of transactions with foreign companies.

We are hopeful that now taxpayers have become more conscious about including foreign companies in the business transactions flow. In any case, we strongly recommend assessing how the current business structure correlates with the approaches developed by tax authorities to the issue of determining the beneficial owner of income with the purpose of promptly taking measures aimed at minimizing risks.

Specialists of Korpus Prava have extended experience in international tax planning and are ready to provide full assistance in applying the concept of the beneficial owner of income, including analysis and optimization of the existing structure, support of tax audits and legal cases with regulatory authorities.

Your subscription to our journal will definitely boost the efficiency of your specialists and downsize your expenses for consultants.

The journal is available free of charge in the electronic version.

Free Download